DG Mail

DG Mail is an online magazine that provides you with the latest news from the Digital Garage Group.

If you would like to subscribe to DG Mail, please fill out the form.

Designing

New Context

Designing

New Context

CEO Comments

2026.02.12

CEO Comment Vol.85 “Summary of Financial Results for the Third Quarter of the Fiscal Year Ending March 31, 2026 [IFRS] (Consolidated)

<Infrastructure reconstruction underway to enhance mid- to long-term corporate value towards the coming fiscal year>

Following approval by the Board of Directors today, we announced the financial results for the third quarter of the fiscal year ending March 2026.

Consolidated profit before tax for the nine months ended December 31, 2025, was ¥4,559 million—an increase of ¥12,151 million compared to the same period last year. This increase was primarily due to the reversal of non-cash investment valuation losses recorded in the Global Investment Incubation (GII) segment during the prior year. Below is an overview of each segment.

In the Platform Solutions (PS) segment, centered on payment platforms, the marketing business maintained strong performance. Meanwhile, the payment business saw a 14% increase in transaction volume and a 4.7% increase in profit before tax. The PS segment’s short-term performance is currently in a single-digit growth phase. We view this as a temporary transition driven by three overlapping factors:

Below, we outline the progress on our collaborations with strategic partners ((1) KDDI Group / (2) Resona Group).

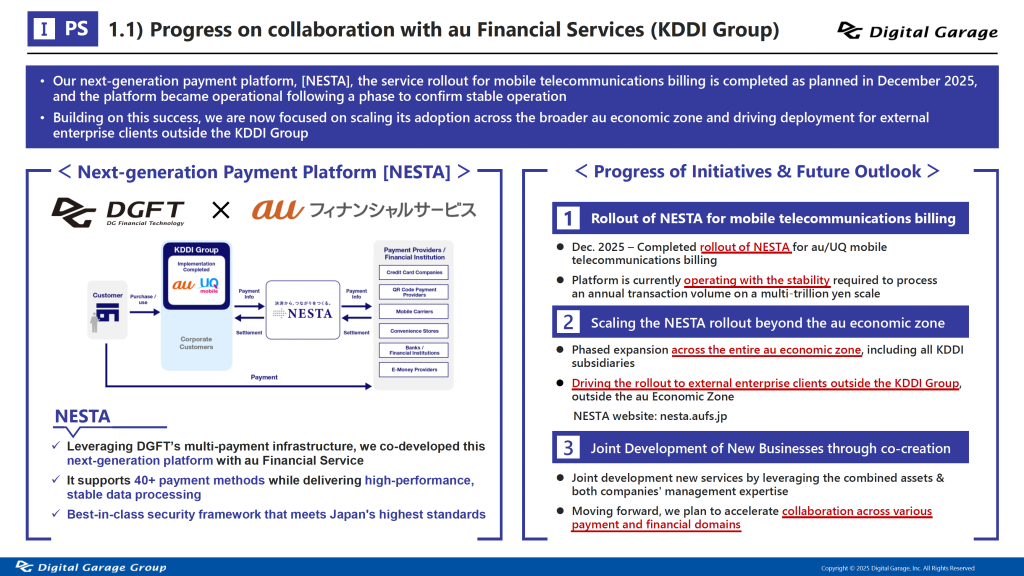

Following a business alliance agreement in May 2024, Digital Garage Group and au Financial Service Corporation (KDDI Group) jointly developed the next-generation payment platform “NESTA.” Today, we announced the launch of payment processing services for au/UQ mobile communication charges. The service rollout was completed as planned in December 2025 to support annual transaction volumes expected to reach the trillions of yen. After a stable operation confirmation phase, we made this joint announcement.

DGFT and au Financial Services will collaborate to deploy the payment system “NESTA” across KDDI Group services and expand its availability to companies beyond the KDDI Group.

The companies will accelerate joint development of new payment services for mid- to long-term growth. By combining their management resources with payment expertise and capabilities, they aim to increase market share in the expanding cashless market and strengthen their industry position.

“NESTA” is built on DGFT’s multi-payment service “VeriTrans4G” and features top-tier domestic security standards. It supports over 40 payment types and delivers high-performance, stable data processing.

1. Expanding NESTA Within and Beyond the au Economic Zone

We will first deploy NESTA across all KDDI Group services, then extend it to corporate clients outside the Group and beyond the au economic zone.

2. Co-Creative Collaboration for Joint Development of New Businesses

Digital Garage Group and au Financial Services will jointly develop new payment services to support medium- to long-term business expansion. Following “NESTA,” we will promote the deployment of acquiring systems as our next collaboration.

We will strengthen our joint sales structure and combine our management resources with expertise in the payment domain to accelerate collaboration in the payment and financial areas. Specifically, we will promote joint sales of new products within and beyond the au economic ecosystem. We will also significantly increase the number of personnel seconded from our company to build a more integrated sales structure, further advancing our ongoing personnel exchange.

We will propose platform businesses and other initiatives that integrate with various services of the KDDI Group to create next-generation businesses.

Digital Garage Group operates at the intersection of telecommunications and payments—two pillars of modern infrastructure. We will create innovative businesses that deliver new value beyond incremental functional enhancements.

Below are slides on the progress on our partnership with au Financial Services.

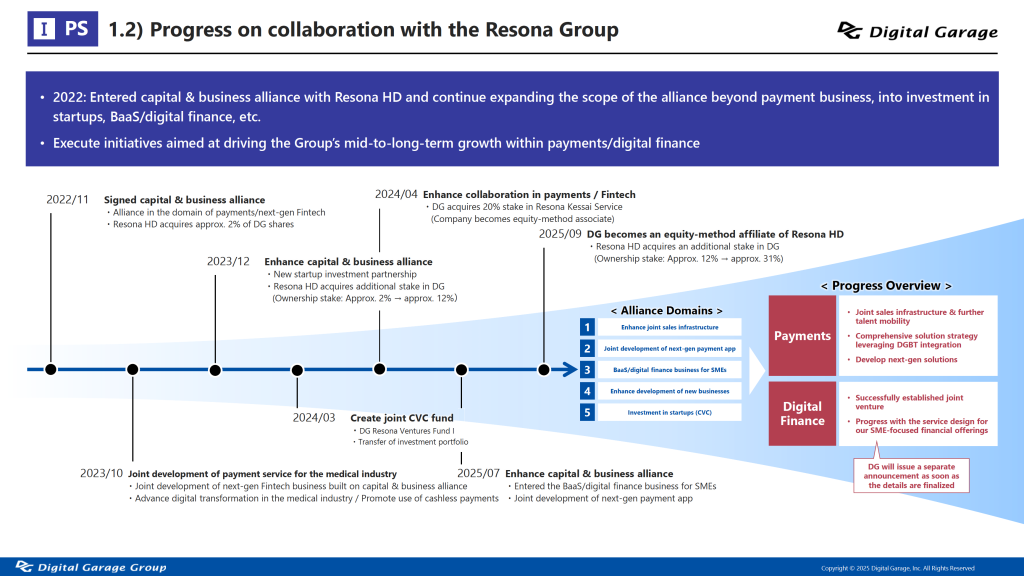

Following capital and business alliances in 2022 and 2025, we have strengthened our partnership with Resona Group through strategic personnel exchanges and the expansion of payment businesses in Tokyo and Osaka. We are currently implementing and preparing the following strategic initiatives:

– Joint sales of PSP business across all branches and support for customer DX transformation

– Investment in next-generation fintech startups through a joint CVC fund

– Joint development of application-based payment services to replace legacy payment terminals

– Business design of BaaS/digital financial services for SMEs, leveraging one of the largest customer bases among major banks

(Currently in the final planning stage for SME financial services through a joint venture. We will disclose this project at the appropriate time.)

Below are slides on our collaboration with Resona Group.

In the Long-Term Incubation (LTI) segment, strategic businesses such as “AppPay,” one of Japan’s largest out-of-app payment services, and “Musubell,” one of Japan’s largest real estate DX platforms, continued to grow. As business losses narrowed, profit before tax increased by 26%.

In the Global Investment Incubation (GII) segment, we are steadily advancing the sale and off-balance-sheet repositioning of our investment portfolio to reach our medium-term target of ¥30 billion in investment business income. Progress has now surpassed 50%. Following engagement with major domestic investment players, we have begun negotiations with major global players to achieve this goal.

We are collaborating with strategic partners while building short-term performance and undertaking structural reviews to improve medium- to long-term corporate value. We are advancing these discussions at the board level. Specifically, we are comparing and examining multiple options for our business portfolio and capital structure.

The Company is currently transitioning its growth model—from growth based on accumulating payment transaction volume to growth accompanied by profitability and repeatability. We are curbing exceptional discount deals and streamlining high-cost projects, selecting opportunities that emphasize operating profit and operating profit margin.

Our initiatives with au Financial Services (KDDI Group) currently prioritize operational stability and quality over short-term sales and profits. Revenue contributions are expected to emerge gradually and drive growth in the PS segment in the next phase.

We are currently evolving from “a company that simply processes payments” to “a company that redesigns industries starting from payments” through deepening collaboration with strategic partners, advancing marketing solutions originating from payments, and initiatives for the AI search era including GEO.

We would like you to focus not only on short-term growth rates when evaluating our medium- to long-term direction, but also on the structural transformation creating next-generation ecosystems for the AI era.

Going forward, we will continue to emphasize three priorities:

– Business simplification

– Strengthening execution capabilities

– Securing growth potential for the future

We will prioritize these three points and make careful, steady decisions without being influenced by short-term evaluations. We will share updates on our progress at the appropriate time.

New technologies like generative AI and blockchain are transforming the business landscape. We are steadily preparing for the evolution into next-generation businesses.

Digital Garage and DG Business Technology (DGBT) have jointly developed and launched AI search optimization (GEO) support services. This service seamlessly integrates through to payment, preparing for the era of agentic commerce—where AI selects products and processes payments.

DGFT’s “Cloud Pay Series,” a unified QR code payment solution, started with integration with Square, one of the world’s largest payment platforms. It is now expanding into IoT markets including vending machines, parking lots, laundromats, and amusement facilities. Our collaboration with AEON Fantasy marks the full-scale launch of next-generation marketing solutions built around QR code payments.

In January 2026, we agreed to collaborate with JCB, and Resona Holdings on the social implementation of stablecoin payments. DGFT is preparing to implement stablecoin payments. This technology is expected to deliver significant benefits, including reduced remittance costs and enhanced inbound services. The three companies plan to conduct proof-of-concept trials to address practical challenges and develop new business models tailored to the Japanese market.

This fiscal year, we began providing OEM payment engine services to other companies for the first time. From an e-commerce perspective, a dramatic shift is underway with the emergence of AI—from search engine optimization (SEO) to generative engine optimization (GEO). Blockchain technology is also transforming remittances and data management. To address these environmental changes, we view this fiscal year as focused on rebuilding the foundation to optimize our group’s business structure and overall operations.

We respectfully request the continued support of all our stakeholders.