DG Mail

DG Mail is an online magazine that provides you with the latest news from the Digital Garage Group.

If you would like to subscribe to DG Mail, please fill out the form.

Designing

New Context

Designing

New Context

Financial Summary for FYE 2012 and new Midterm Three Year Business Plan Digest

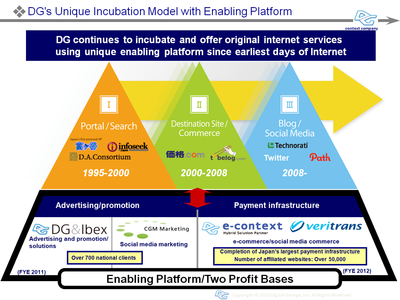

With the approval in today’s board meeting, the FYE 2012 financial summary has been officially disclosed also with the decision for the company split of “e-context Company” to allocate a subsidiary company in Hong Kong having the same payment functions but with a more global vision. (e-context company functions as the payment infrastructure supplier in the hybrid solution segment) The following will explain the background and aim by outlining the new midterm three-year plan.

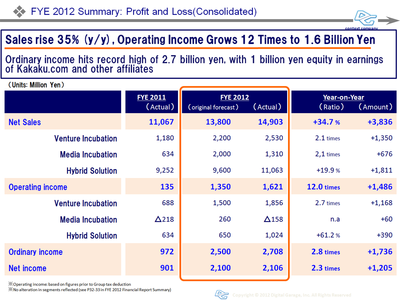

I. I. FYE 2012 Financial Highlights

17th term exceeded forecast and recorded past highest profit

Hybrid solution business (Advertising/ Promotion) known as the “Enabling Platform” and core element of DG’s business model, lead the first half of the financial closing to a large gain in profit, as well as the exit of shares in the Venture Incubation segment.

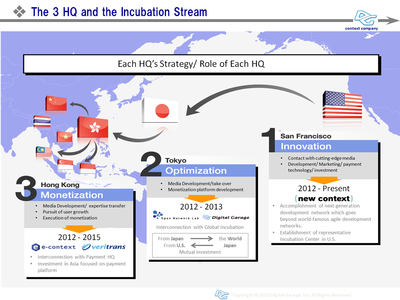

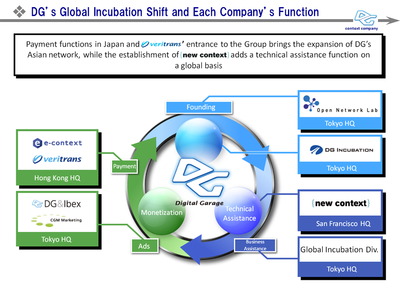

Began developing a global technology development structure

New Context was established as the technology head quarter and developed a global agile development network in San Francisco. Together with the incubation center officially opening early next year, the framework of the “Incubation Stream” has completed. This stream will function as DG Groups’ source of incubation and enable to connect potential incubation cases in Silicon Valley with the Asian market.

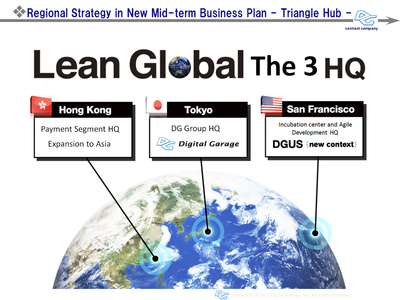

(see chart below for the 3 HQ’s)

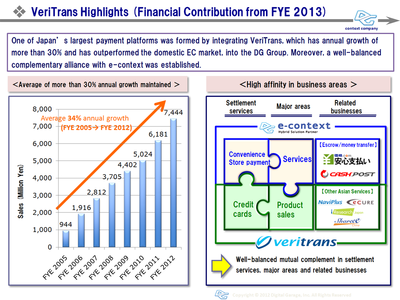

Strengthening the Enabling Platform

With VeriTrans joining the DG Group, we have achieved to become Japan’s largest payment infrastructure. e-context, beginning its business with convenience store payment, has a high service capability while VeriTrans started their business with credit card payment and has strength in product sales. Thus, the two have a very high compatibility, and have developed a supplementary relationship in order to enlarge the payment market.

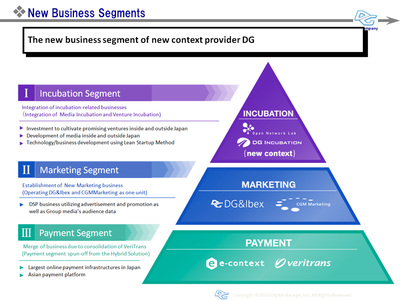

II. The company split of e-context and establishment of a subsidiary payment company in Hong Kong

The subsidiary company, econtext Asia Limited, will become the head quarter for the global development of the payment business which supports DG Groups’ business model. As the core of this company, VeriTrans and e-context will unite their experiences with payment business in Japan and the most recent technology to customize and develop payment platforms beginning with Asia. VeriTrans has already established a joint venture company in Indonesia, which will commence its business to full-scale in September 2012. Also, through providing payment services in Asia, we will layout a structure to excavate and participate in early stage investments for potential startups. Please pay attention to the movements from new segment and head quarter in Hong Kong. (In order to accomplish the global development, the segments has been reorganized to : Venture Incubation, Marketing and Payment.)

III. Mid-term three-year business plan

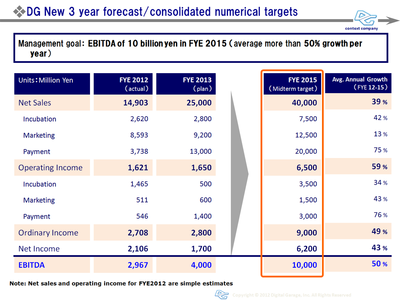

~Lean Global~ Mid-term EBITDA Target: 10 billion yen (growth rate 50% /y)

Putting this new movement in to terms, the concept for the mid-term three-year business plan has been decided to be “Lean Global”.

The key word for the “Lean Global” concept is the “trilateral structure”. DG has been developing its business centered on the two bases, Tokyo as the global head quarter and the San Francisco, where there is the agile development subsidiary, New Context and the incubation center opening early next year. After establishing the subsidiary company for payment businesses in Hong Kong, decision-making can be done promptly within the three head quarters, Japan, San Francisco and Hong Kong. As these three head quarters collaborate, DG’s business model deriving from incubation, technology and business development support and monetization can expand by the “Lean” method to the “Global” market.

This coming financial term will be a term of preparation for DG’s globalization. Conservative numbers for investment revenue, developing costs for New Context’s agile development network and amortization expenses for VeriTrans and other M&A’s makes the plan seem static, however, the expected growth for the EBITDA is more than 30% y/y.

In addition, from this financial term, the management standard will be based on EBITDA (earnings before interest, taxes, depreciation and amortization) as the accounting standard will shift to International Financial Reporting Standards (IFRS). The target has been set to a 50% growth rate each year for 3 years, thus an EBITDA of 10 billion Japanese Yen by the third year. In order to accomplish this, DG will allow the three head quarters to collaborate and continue to design a new context for the next generation.

On the 28th to the 29th of September, our annual conference, THE NEW CONTEXT CONFERENCE 2012 TOKYO will be held in Ebisu, Tokyo. This year’s conference is based on the theme “The Movement of Next-Generation Online Business Arising From Open Innovation – Beyond The Smartphone Era -.” Opinion leaders from Japan and the globe will be invited to discuss the Lean Global concept with the audience on two viewpoints, “Internet devices” and “E-commerce.” Also, we are planning to host “THE NEW CONTEXT CONFERENCE 2013 SAN FRANCISCO” in Spring 2013 at the newly opening incubation center.