DG Mail

DG Mail is an online magazine that provides you with the latest news from the Digital Garage Group.

If you would like to subscribe to DG Mail, please fill out the form.

Designing

New Context

Designing

New Context

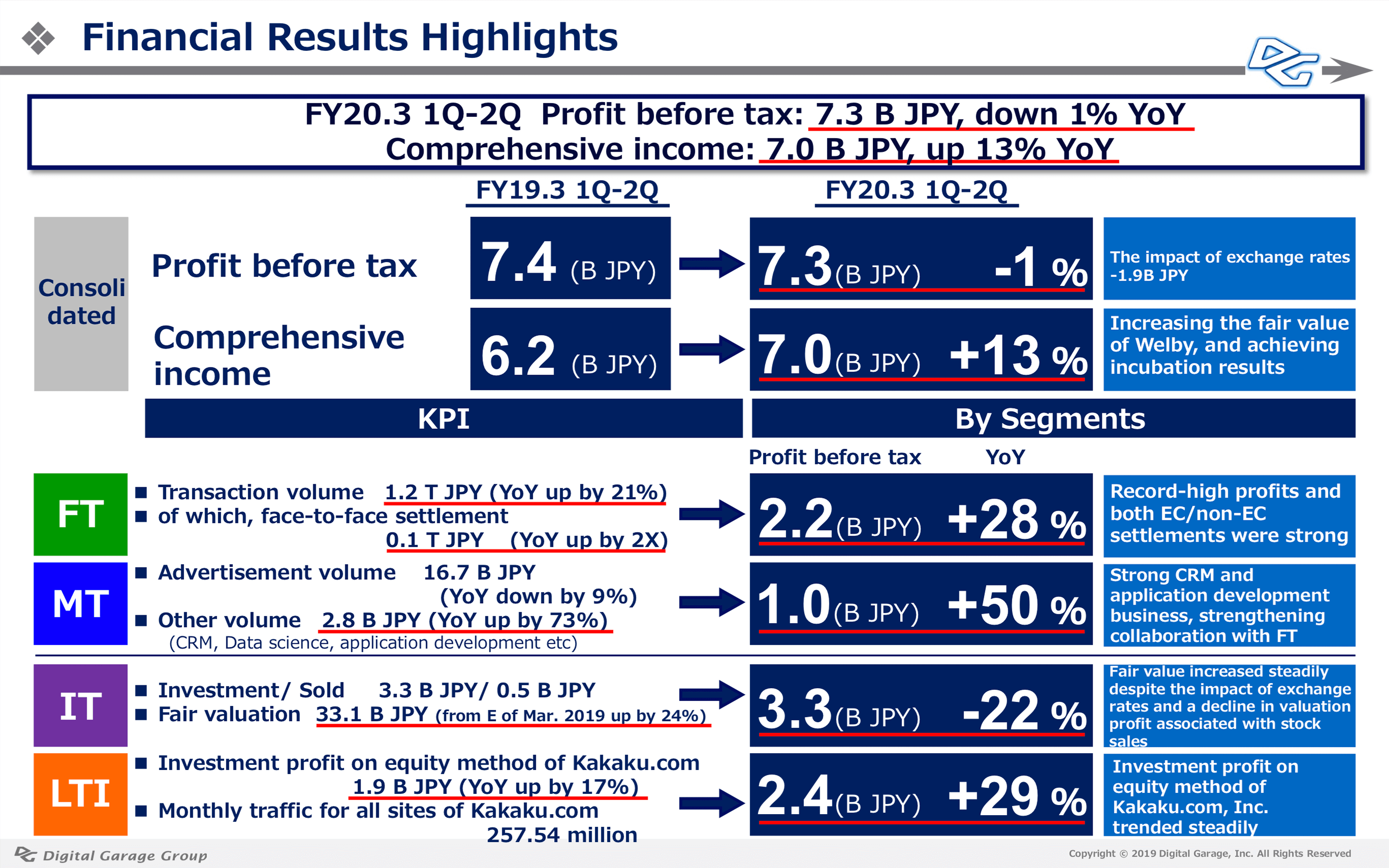

With the approval of the Board of Directors today, we have announced FY20.3 second quarter financial results. The following is a report of the financial summary of FY20.3 second quarter.

■ Overview

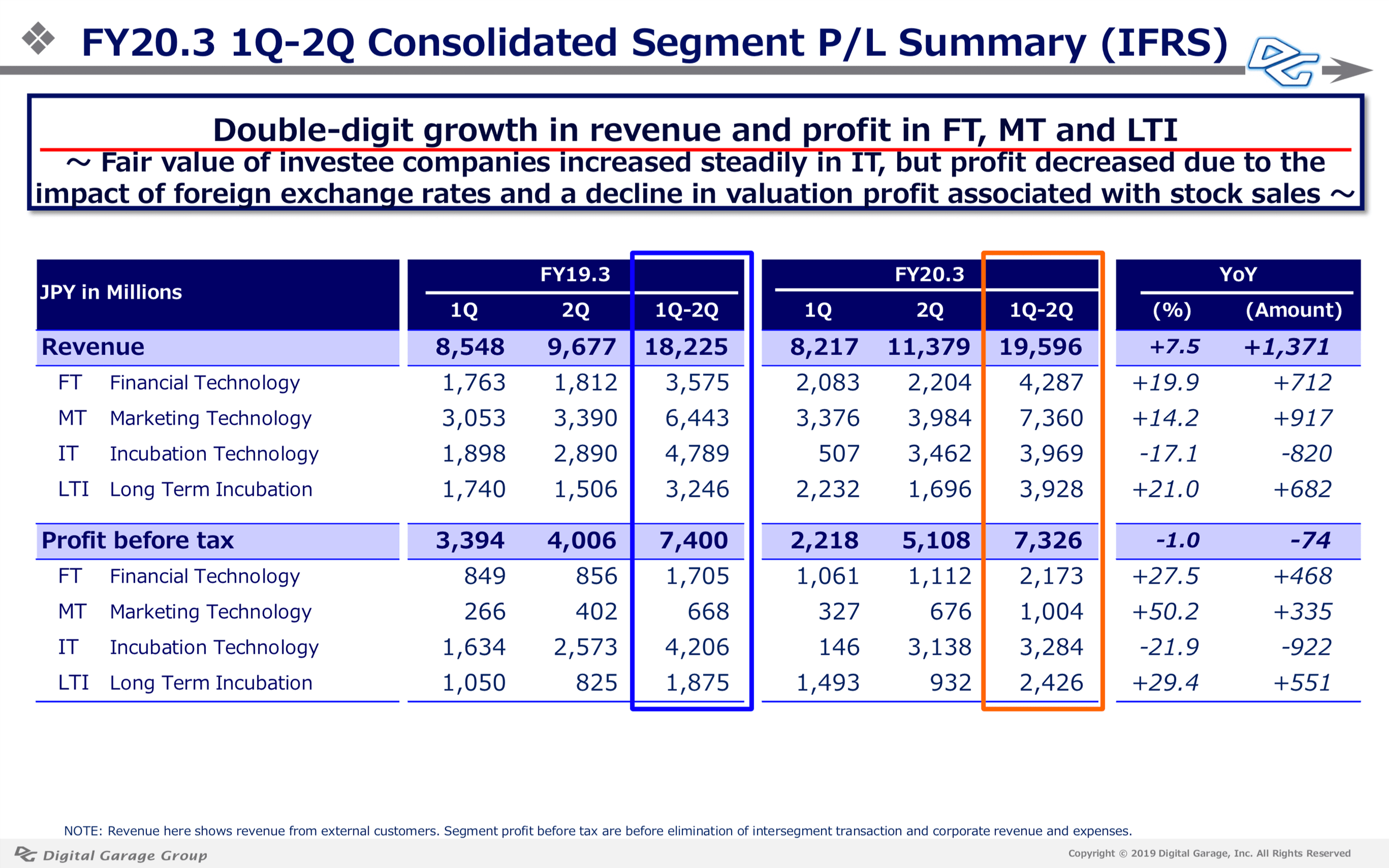

Revenues for the six months ended September 30, 2019 amounted to 19,596 million JPY (up 7.5% YoY) and profit before tax amounted to 7,326 million JPY (down 1.0%). As in the first quarter, the impact of exchange rate fluctuations on consolidated results for the six months ended September 30, 2019 was approximately 1.9 billion JPY, resulting in a decrease in profit. Excluding the impact of exchange rate fluctuations, we expect profit before tax to increase more than 20% YoY. Growth accelerated in the second quarter, with profit before tax of 2,218 million JPY for the first quarter and profit before tax of 5,108 million JPY for the second quarter. In addition to growth in the recurring businesses of Financial Technology (FT) and Marketing Technology (MT), in addition to the increase in the gain on valuation of IT (Incubation Technology), Kakaku.com’s equity in earnings of affiliates contributed to this growth. In addition to outpacing the growth in the recurring businesses of FT (Financial Technology) and MT (Marketing Technology), the increase in the gain on valuation of incubation technology businesses and the contribution of equity in earnings of affiliates of Kakaku.com also contributed.

■Summary by business segment

In the Financial Technology(FT) segment, high growth continued, with revenues of 4,287 million JPY (up 19.9% YoY) and profit before tax of 2,173 million JPY (up 27.5%) for the first half of the fiscal year. Transaction volume, the KPI for this segment, increased 21% YoY to 1.2 trillion JPY, and face-to-face payments, which we are focusing on, increased 2.0 times YoY to 106.8 billion JPY. In addition, the number of transactions increased 20%, to 220 million, and we recorded a significant increase in profit, thanks in part to improved profitability stemming from the expansion of scale, which is a characteristic of this business.

We, DG Group, launched “Cloud Pay”. This merchant-presented mode (MPM) multi-QR Code payment solution makes it possible for consumers to scan QR Codes displayed at stores with their smartphones to make payments.

With “Cloud Pay”, QR Code and barcode payment services including d Payment, Alipay, WeChat Pay, Merpay, LINE Pay, AlipayHK, and Kakaopay can be offered all at once,

This service offers many benefits, for instance, participating merchants can introduce multiple payment services at once without any installation burden or costs. Transactions for various payment methods can be managed on the app for participating merchants, which helps reduce the number of people needed for administration and accounting tasks.

DG Group will not only respond to inbound demand, including the 2020 Tokyo Olympics and the 2025 Osaka Exposition, but also contribute to the realization of a cashless society in Japan.

In the Marketing Technology (MT) segment, revenue increased 14.2% YoY to 7,360 million JPY and profit before tax increased 50.2% to 1,004 million JPY, then recorded significant increases in both revenue and profit. The settlement app development business linked to the FT business, which is one of the strengths of this segment, and the client’s e-commerce mall management business, etc. performed well, and the strategy aimed at improving profitability in the mainstay digital ad business was successful. In addition, CyberBuzz, Inc. an equity-method affiliate listed on the Mothers section of the Tokyo Stock Exchange in September 2019, is expanding its unique influencer marketing business that utilizes social networking services such as Instagram and Facebook, and is contributing to our earnings.

In the IT (Incubation Technology) segment, revenue was 3,969 million JPY (down 17.1% YoY) and profit before tax was 3,284 million JPY (down 21.9% YoY), with both revenue and profit declining. This was mainly attributable to a 1.4 billion JPY decrease in the fair value of securities held due to the appreciation of the yen. On the other hand, the fair value, excluding foreign exchange fluctuations, increased by about 2.3 billion JPY from the same period of the previous fiscal year, and the appreciation of the global investee continues. The balance of operational investment securities held by Digital Garage Group was 33,114 million JPY, up 24% (6,419 million JPY) from the end of the previous fiscal year.

In the incubation business that discovers promising companies around the world and provides business support, DG Daiwa Ventures has established DG Lab Fund II, an investment fund for global startups with next-generation technologies. The first round has closed as of August 2019 with a total amount of over 10 billion JPY. DG Daiwa Ventures Inc. invest in promising Japanese and foreign startups in DG Lab’s five R&D fields: Blockchain, AI, VR/AR, Security, and BioHealth, moreover incubate them.

In the Long-Term Incubation (LTI) segment, revenue was 3,928 million JPY (up 21.0% YoY) and profit before income taxes was 2,426 million JPY (up 29.4% YoY). Kakaku.com, Inc., an equity-method affiliate, performed well in “Tabelog” business, “New Media and Solutions” and “Finance” businesses.

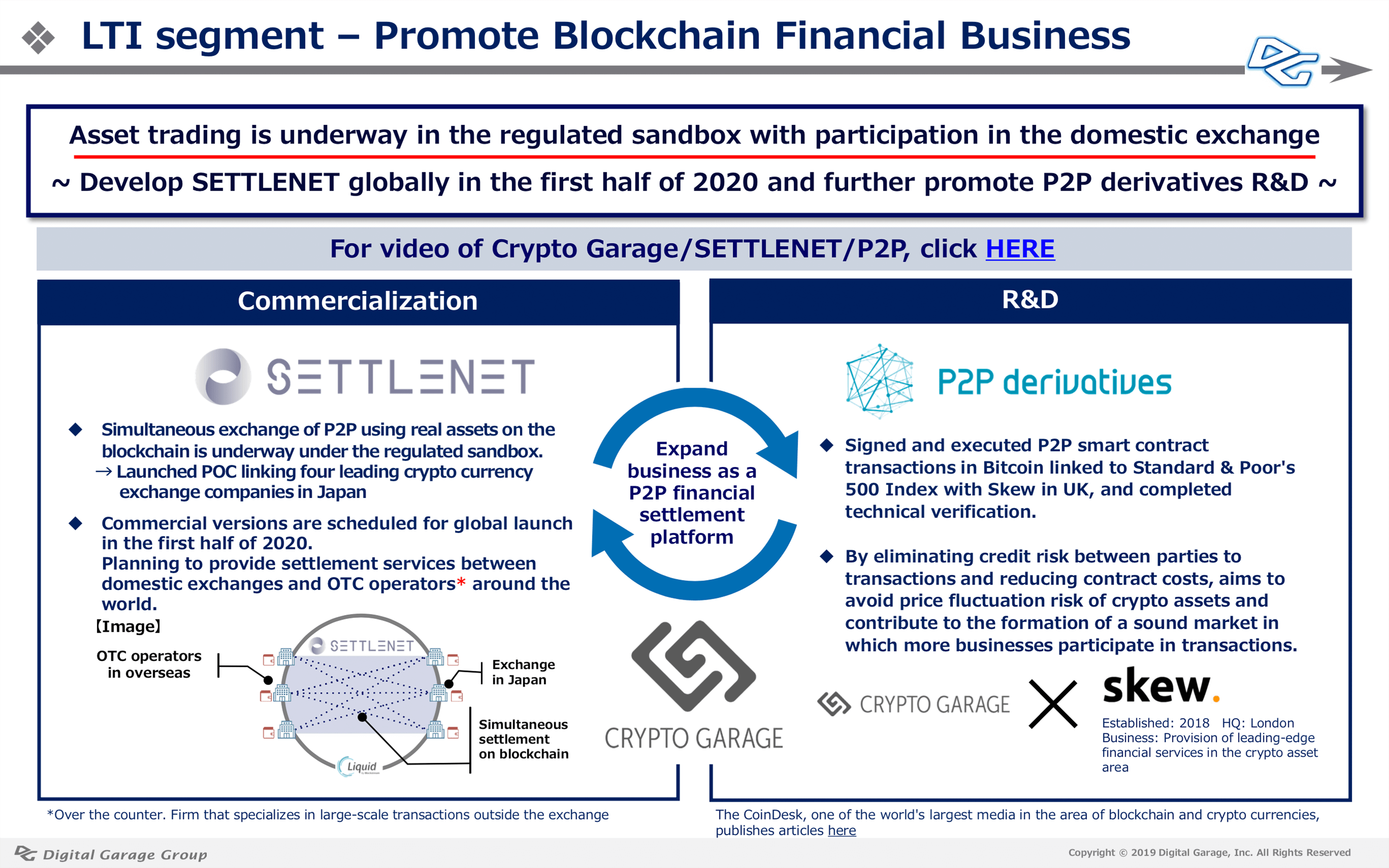

Crypto Garage received official authorization to conduct the first blockchain and finance project under the Regulatory Sandbox in Japan, which is managed by Cabinet Secretariat of Japan, in January 2019. Under the regulatory sandbox, Crypto Garage has been conducting trials of simultaneous P2P exchange transactions using real assets in blockchains together with the major cryptographic asset exchanges in Japan. This will enable rapid, secure and confidential transfer of the crypto assets while eradicating counterparty risk. In the first half of 2020, Crypto Garage plans to launch a commercial version of SETTLENET globally, which enables peer-to-peer simultaneous exchange of crypto assets among the two P2P financial payment platforms Crypto Garage provides.

Moreover, Crypto Garage developed a P2P crypto asset derivative contract protocol and executed a contract based on this protocol on the Bitcoin Blockchain. This project also is progressing smoothly. In September 2019, Crypto Garage signed and executed P2P smart contract transactions in Bitcoin linked to S&P 500 Index with Skew in UK, and completed technical verification. It has also been covered in global media and is attracting attention mainly in the crypto industry.

【Crypto Garage Introduction Movie】

https://vimeo.com/323398805/b8100e34d3

【Reference articles】

https://www.coindesk.com/tiny-217-options-trade-on-bitcoin-blockchain-could-be-wall-streets-death-knell

In the cryptocurrency industry, DG Lab and Crypto Garage has been attracting attention at global conferences, and we strongly think the incubation center DG717 in San Francisco is beginning to be recognized as a base for exchanging and disseminating information in the cryptocurrency industry.

In DG717, which marks its seventh anniversary, we held a NEW CONTEXT CONFERENCE 2019 San Francisco on the theme of Designing with Data: From Cells to Space. On the day before NEW CONTEXT CONFERENCE, in order to create a “Dragon Gate(Gateway to success) ” where Asian IT ventures grow one after another, just as carp go beyond the rapids and turn into ”Dragon”, we installed the dragon ceiling painting which is a masterpiece of Japanese painting in DG717 with the support of the families of Japanese painter Matazo Kayama and the head temple of Nichiren Shu Minobusan Kuonji and held the opening ceremony for it with people from consulate-general of Japan in San Francisco, Kayama Family, and Nichiren Shu.

We will celebrate its 25th anniversary in 2020. As a company that creates contexts that change and make the world better, we vigorously pursue R&D and business development through DG Lab and Crypto Garage in next-generation technological domains, based on stable growth in the recurring business(FT & MT segment) and LTI business(Kakaku.com) .

We look forward to the continued support and encouragement of our shareholders and other stakeholders.