DG Mail

DG Mail is an online magazine that provides you with the latest news from the Digital Garage Group.

If you would like to subscribe to DG Mail, please fill out the form.

Designing

New Context

Designing

New Context

CEO Comment Vol.71 “First year of new Mid-term Plan/ the first quarter of FY2021.3”

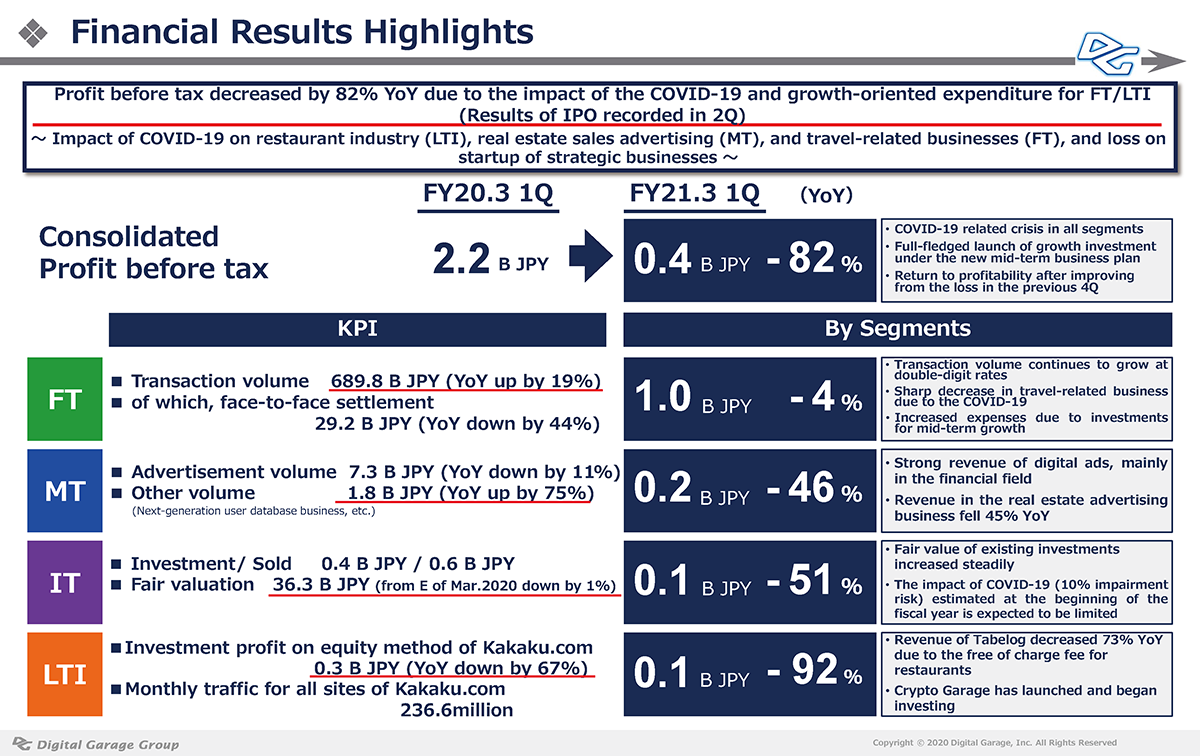

With the approval of the Board of Directors today, we have announced FY21.3 first quarter financial results. The following is the slide of financial results highlights.

Although the above-mentioned declines in revenues and profits were recorded, we recognize that on a fact basis there will be the following six categories.

1) Affected by the COVID-19 in all business segments

2) FT: travel-related, MT: real estate sales advertising, IT: financial delay, LTI:restaurant-related

3) Recovery trend after bottoming out in the fourth quarter of FY2020.3

4) FT transaction value grew by 19% YoY to 689.8 billion JPY

5) The impact (impairment loss) of IT’s fair value of securities is expected to be only 1% at the initial rate of 10%.

6) Prior investments to achieve the target of Mid-term Plan (FY2021.3-FY2025.3)

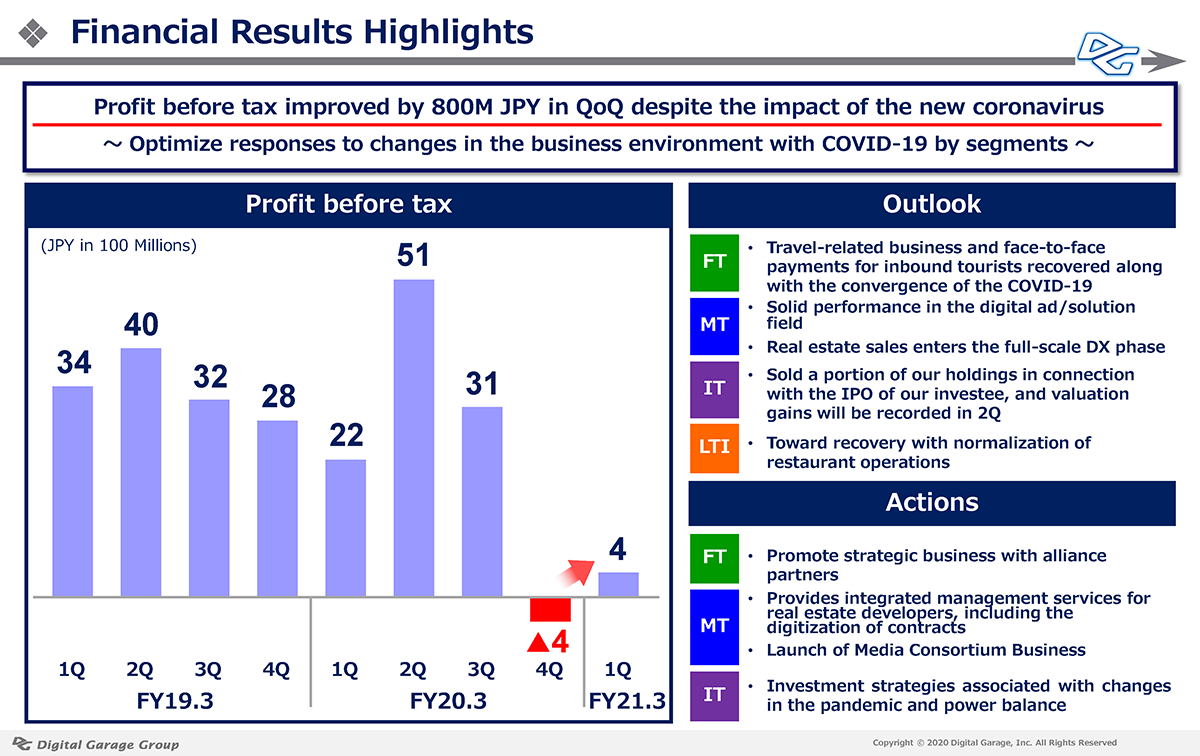

On the other hand, I summarize the results for the first quarter. In addition to the temporary decline in Tabelog due to the pandemic, foreign exchange losses due to the strong yen, significant decline in real estate advertising, and investment in growth in next-generation businesses under the new Mid-term Plan, profits declined significantly in the first quarter of the fiscal year due to the conclusion that the initial value of IPO companies at the end of 1Q fiscal year was confirmed in the following quarter (valuation gains were slided to 2Q according to the auditing rules). However, I am aware that we are recovering and adapting from the COVID-19 shock and are heading toward a recovery trend after bottoming out in the fourth quarter of the previous fiscal year through optimization and pivot at the operating company level.

From the previous fiscal year FY20.3 4Q (January-March), which had experienced a pandemic caused by the COVID-19, to the FY21.3 1Q (April-June), which entered the new fiscal year, we saw wide-ranging negative impacts on restaurant, travel, inbound demand, real estate sales, and our business segments in the Marketing Technology Segment (MT), Incubation Technology Segment (IT), and Long-term Incubation Segment (LTI) businesses.

On the other hand, cashless and e-commerce payments have been significantly affected by a going out self-restraint and other factors, and the Financial Technology (FT) business outperformed the plan. In the IT business, the risk of impairment is becoming limited as initially anticipated. In this fiscal year, which is positioned as a growth investment period in the Mid-term Plan, with a target year of FY25.3, we were able to show a recovery trend after bottoming out in the previous quarter. The following is a summary of financial results.

1Q consolidated financial results for the FY21.3 showed significant declines in both revenues and profits, with revenues of 6.944 billion JPY (down 15.5% YoY) and profit before tax of 405 million JPY (down 81.7% YoY). The main factors behind the decline in profits were a 45% decline in real estate advertising sales in the MT business and a 63% decline in equity in earnings of affiliates such as Kakaku.com due to the impact of restaurant operations and restrictions on mobility. Revenues in the FT business increased 12% YoY despite a decrease in inbound payments.

Earnings declined sharply, reflecting a decrease in Kakaku.com’s profit and a loss on the establishment of a Crypto Garage in the cryptographic property field, as well as lower earnings in the real estate advertising field, higher fixed costs due to upfront spending, and the impact of yen appreciation of approximately 380 million JPY. The balance of operational investment securities (holding value) in the IT business, which is a valuation of B/S, was 36.3 billion JPY, almost unchanged from the end of March. In the IT business, we recognize gains or losses on changes in the fair value at the end of the fiscal year. However, since the first price of Goodpatch Inc. on the last day of 1Q was set on July 1 of the following day, we expect to recognize valuation gains from listing on or after 2Q.

We have adopted IFRS (IFRS) and do not disclose consolidated earnings forecasts because it is difficult to reasonably estimate the fair value of financial instruments, particularly investment securities held, at the end of the fiscal year. On the other hand, the impact of the COVID-19 was affected in the restaurant, travel, inbound tourism, and real estate fields, as mentioned above, but we recognize that consolidated results are recovering after bottoming out 4Q of the FY20.3.

By segment, in the FT business, we will provide cashless solutions through multifaceted alliances in the field of face-to-face payments, which is a strategic field, in addition to steady growth in the mainstay EC payments business. In the MT business, we plan to optimize the underperforming real estate advertising field and develop technology-driven initiatives to create new media and advertising value in the era of growth in digital advertising and post-cookie advertising. In the IT business, we will achieve incubation results that support the growth of businesses in which we invest, by increasing the value of our 36.3 billion JPY holdings and combining them with DG Lab Fund with strategic R&D functions.

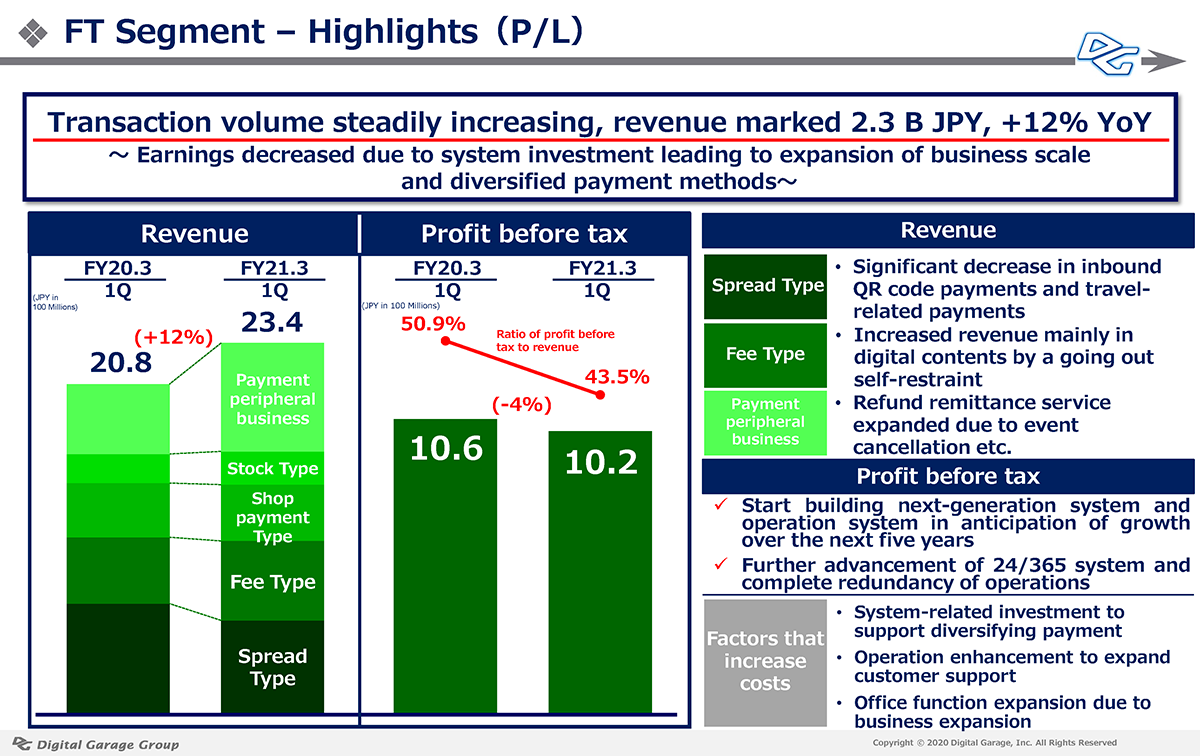

FT Segment: Strong EC payments despite decrease in inbound payments ~Continue investment in growth infrastructure

The transaction value, which is a KPI, continued to be favorable, increasing 19% YoY to 689.8 billion JPY. Revenue increased 12% to 2.3 billion JPY, while profit before tax decreased 4% to 1 billion JPY. Although inbound consumption and payments for travel, department stores, and others declined significantly, E-commerce and digital content payments were robust due to a going out self-restraint.

Profit before tax decreased 4% compared with the same period of the previous fiscal year, due to infrastructure-related investments and office integration costs for growing profits at an annual rate of 20%, which are the numerical targets of the Mid-term Plan (from FY2021.3 to FY2025.3). This is a strategic investment targeting a transaction value of 10 trillion JPY in 2025 (2.6 trillion JPY in the FY20.3). In addition, we are making progress in expanding payment-related areas (marketing, security, and data utilization).

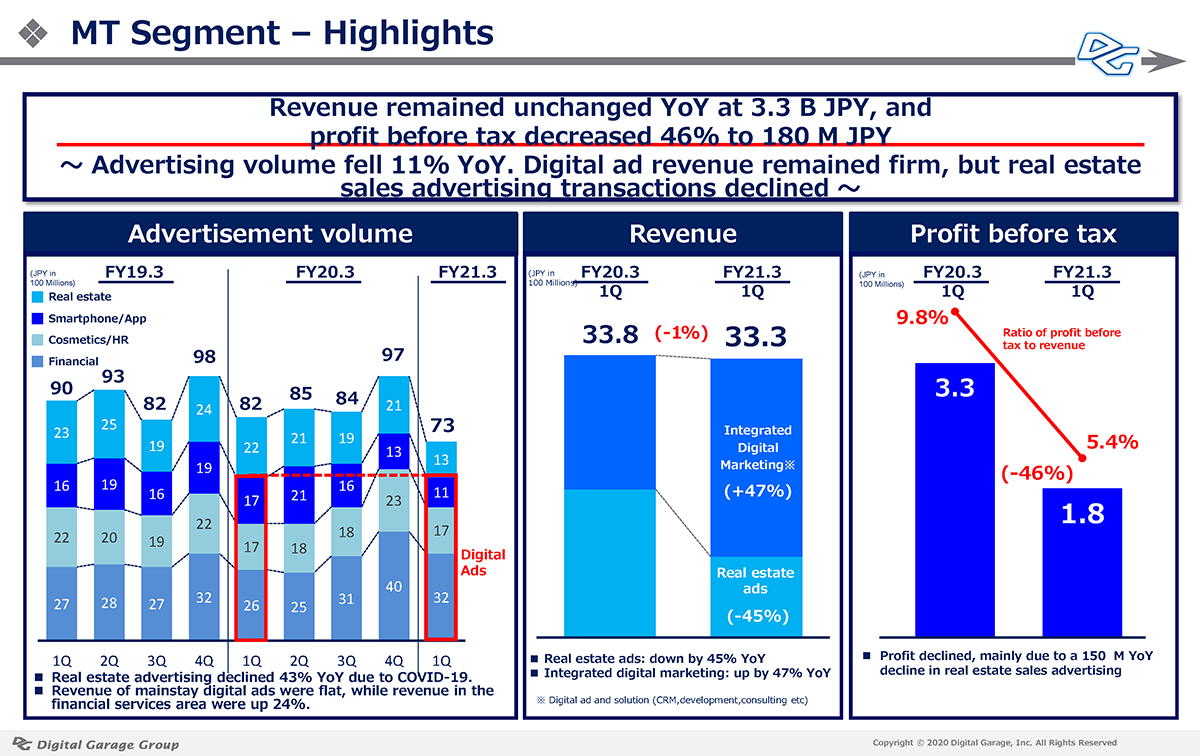

MT Segment: Digital advertising performed well, but real estate sales advertising transactions declined significantly

Total advertisement volume in 1Q decreased 11% from the same period of the previous fiscal year to 7.3 billion JPY. Sales of mainstay digital advertising remained flat, but sales of real estate advertising declined 43% due to the impact of the suspension of operations by COVID-19. As a result, revenues from MT Segment decreased 1% to 3.3 billion JPY and profit before tax decreased 46% to 180 million JPY. Despite a decline in advertising volume, the CRM and solutions business for the financial sector remained strong. In existing advertising domains, we will promote optimization within the year and develop a new marketing strategy by utilizing technology-driven combinations of content, data, and cookieless, which are growth domains.

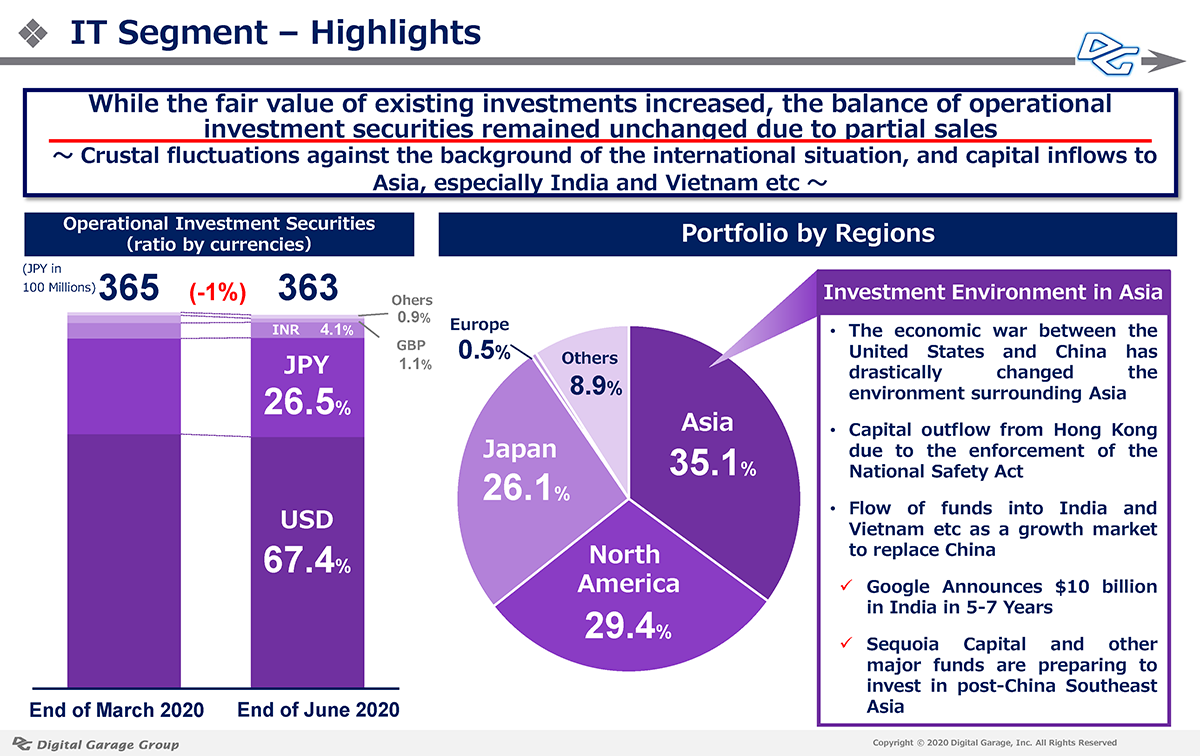

IT Segment:Limited impairment risk as a result of careful examination of post-pandemic investee conditions

As 1Q investment climate was global risk momentum, stock price valuation did not rise. However, the fair value of the portfolio held by DG increased by approximately 500 million JPY from the end of March 2020. After deducting impairment losses and foreign exchange write-downs, we were able to record 400 million JPY in revenues. The impact of the spread of the COVID-19 was expected to be the largest, but the impact on the entire portfolio was only about 1%, which is about one-tenth of the forecast. Looking ahead, we will focus on Asia, which is expected to be revitalized due to a shift from China. As global regions focusing on investment incubation in After/With COVID-19 era, we are focusing on Japan, India, and Vietnam, in particular. As our business sectors, we are focusing on healthcare, Fintech, and artificial intelligence.

LTI Segment: Free fee of tabelog and full-scale launch of a new cryptographic currency business

The LTI business is a segment that aims to achieve long-term growth in operating profits by continuing to hold shares in investee companies and developing new businesses. Our equity in earnings of affiliates decreased 67% YoY, partly due to a 66% YoY decline in profit before tax due to free of charge in the Tabelog business. In addition, in 2019, Crypto Garage, Inc. obtained certification under the regulatory sandbox system, which became the first in the financial sector, and began demonstration experiments on the issuance of yen-denominated tokens and the simultaneous payment of encrypted assets through the use of SETTLENET. In June 2020, it completed connections with several domestic and overseas trading companies, and launched commercial services for simultaneous payment of encrypted assets and Japanese yen funds. A new next-generation financial business that starts in Japan in the global market began full-scale operations.

In the ESG area, we will start collaborating with the NPO launched globally by Joi Ito, DG Board of Directors Member and Co-Founder, and Reid Hoffman. We will begin supporting and promoting social contribution projects that create New Normal, such as the COVID-19 project, by connecting overseas and Japanese intellectuals, companies and educational institutions.

In addition, Open Network Lab, Japan’s first seed accelerator program run by DG, has published the book “Pitch,” to celebrate its 10th anniveresary in July 2020. Thankfully, it has ranked as the best selling book in its category on Amazon.co.jp. As we poured our 10 years of know-how into the book, we hope it will help the next generation entrepreneurs to open up a new future for themselves.

We truly realized that it is time for DG to accelerate collaboration with various partners on a global scale, and continue to create contexts that are useful to the international community in maintaining dynamic equilibrium and neutrality. With a medium- and long-term perspective, we will continue to contribute to global society under the concept of “Designing our New Normal Context” for the next five years as a Context Company, unchanged since its founding.

We look forward to the continued support and encouragement of our stakeholders, including our shareholders.