DG Mail

DG Mail is an online magazine that provides you with the latest news from the Digital Garage Group.

If you would like to subscribe to DG Mail, please fill out the form.

Designing

New Context

Designing

New Context

CEO Comment Vol.77 “FYE March 2022 Second Quarter Financial Report Summary”

Formed capital and business alliance with Resona Holdings and decided acquiring stock totaling 5 billion yen

With the approval of the Board of Directors today, we have announced FY23.3 second quarter financial results (IFRS).

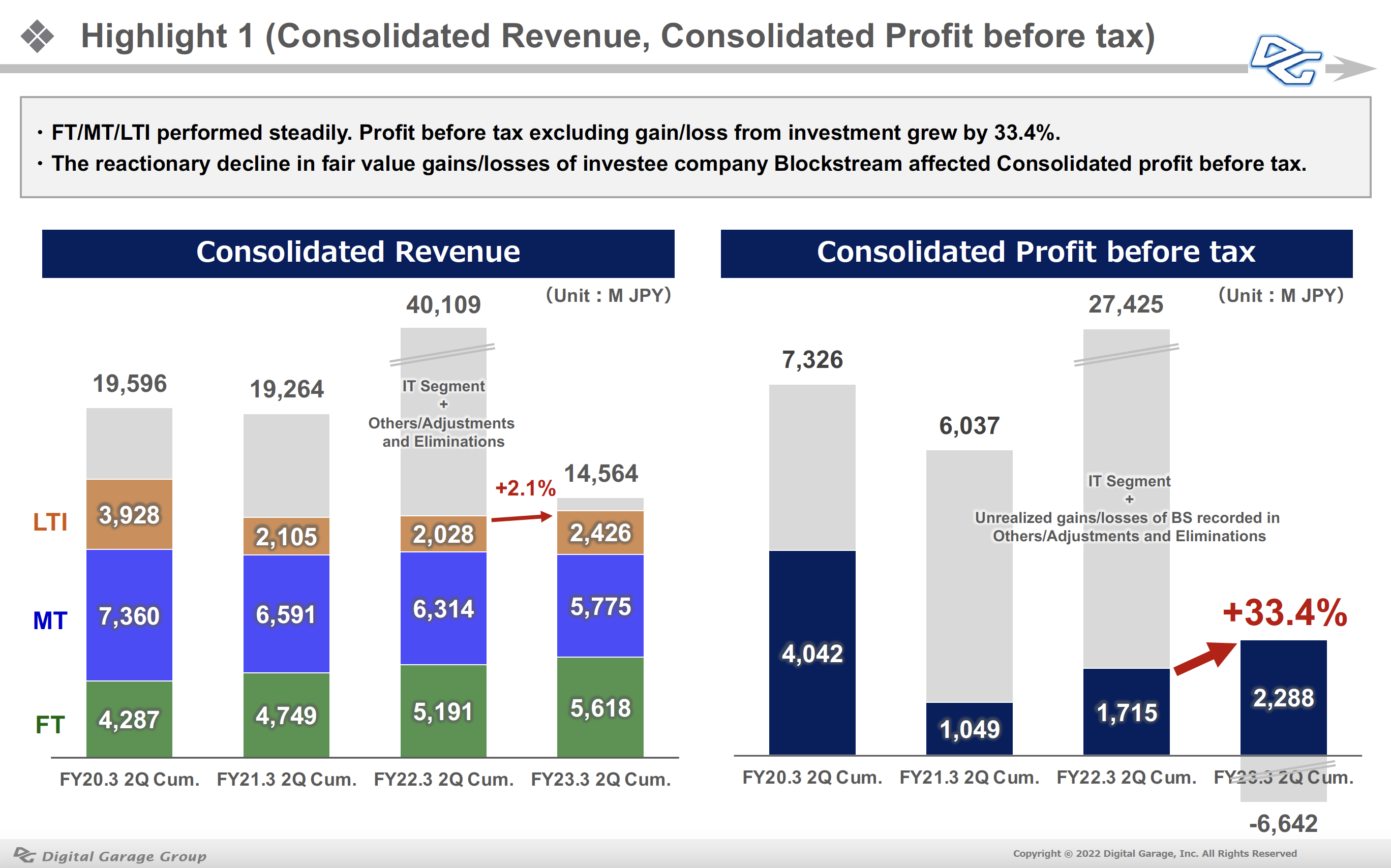

For the first six months of the fiscal year ending March 31, 2023, consolidated revenue was 14,564 million JPY (down 63.7% YoY) and loss before tax was 6,642 million JPY (Profit of 27,425 million JPY in the same period of the previous year).

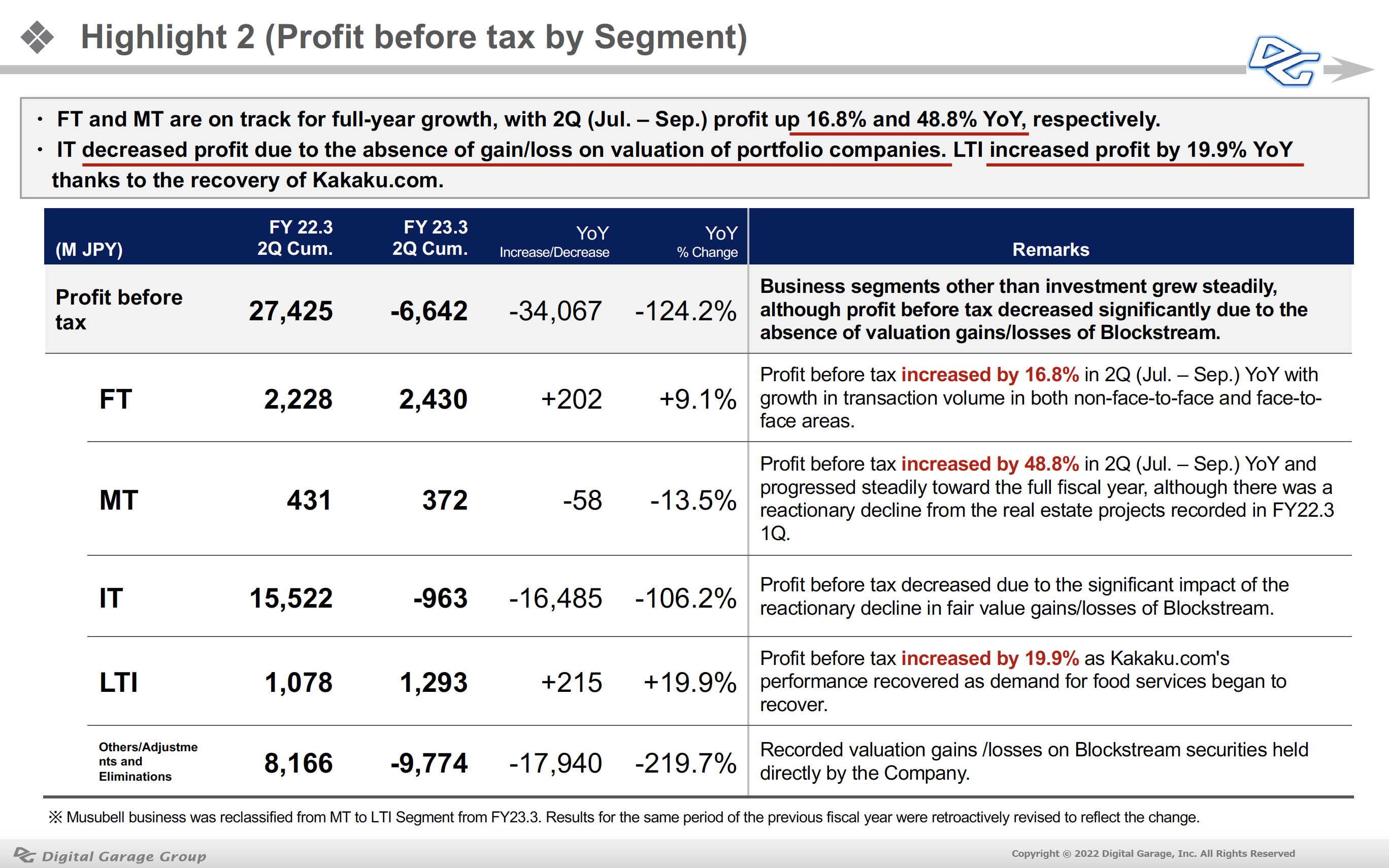

Payment transaction volume in the Financial Technology (hereafter, FT) business continued to grow strongly, and in the Marketing Technology (hereafter, MT) business, the mainstay digital ad business performed well, especially in handling credit cards and other finance-related transactions. In the Long Term Incubation (hereafter, LTI) business, the performance of Kakaku.com, Inc. was on a recovery track. On the other hand, the Group as a whole was significantly negatively impacted by a decrease in the fair value assessment of our portfolio company, Blockstream Corporation Inc. (hereafter, Blockstream), which had increased significantly in the same period of the previous year. As a result, the Incubation Technology (hereafter, IT) business and the corporate division that is not part of any business segment reported a loss before tax for the quarter.

We would like to supplement our fair value assessment of Blockstream. We took an equity stake in the company at an early stage in 2016, based on a business partnership. Subsequently, we recorded a large valuation gain (IFRS) reflecting the valuation at the time of the company’s fundraising last year. On the other hand, for the 2Q of this fiscal year, the valuation at the time of the company’s October fundraising resulted in a large valuation loss (IFRS). This treatment is based on the IFRS rule of reflecting fair value valuation in a timely manner, which is not the case under Japanese GAAP, and both of these gains and losses are non-cash-in, non-cash-out gains and losses.

Although our business performance was significantly affected by the change in valuation of one investee company, valuation gains and losses (IFRS) do not affect cash flow.

Profit before tax, excluding gains and losses related to investments in IT and corporate division, increased by 33.4%, with steady progress, especially in the FT and LTI businesses.

In addition, the Company has decided to repurchase its own shares for a total amount of 5 billion JPY (maximum). We have always positioned the return of profits to shareholders as an important management issue, and will continue to make it our basic policy to return profits to shareholders through cash flow-conscious management, taking into consideration our financial situation and stock price.

Please see the following slides.

The following is a segment review.

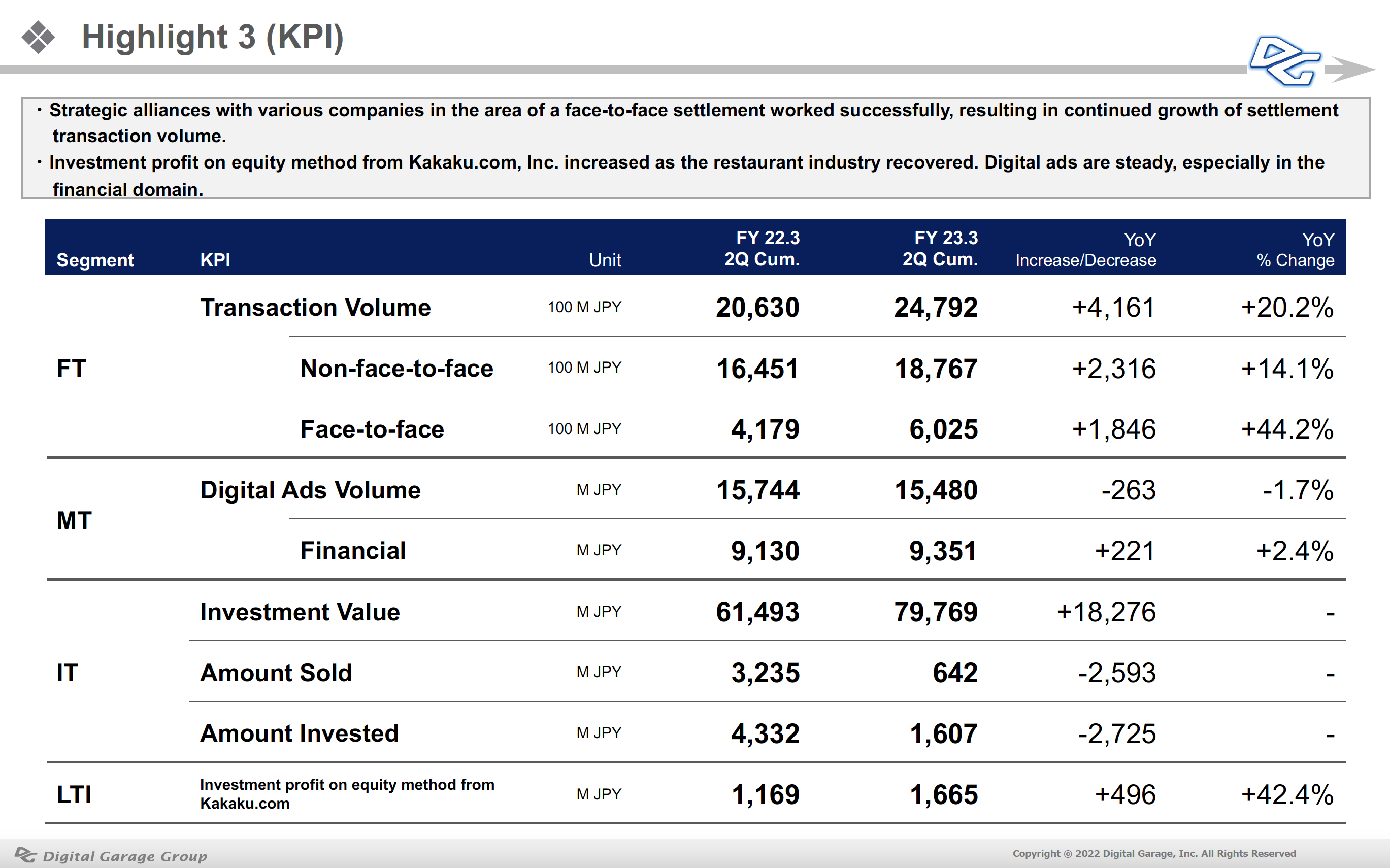

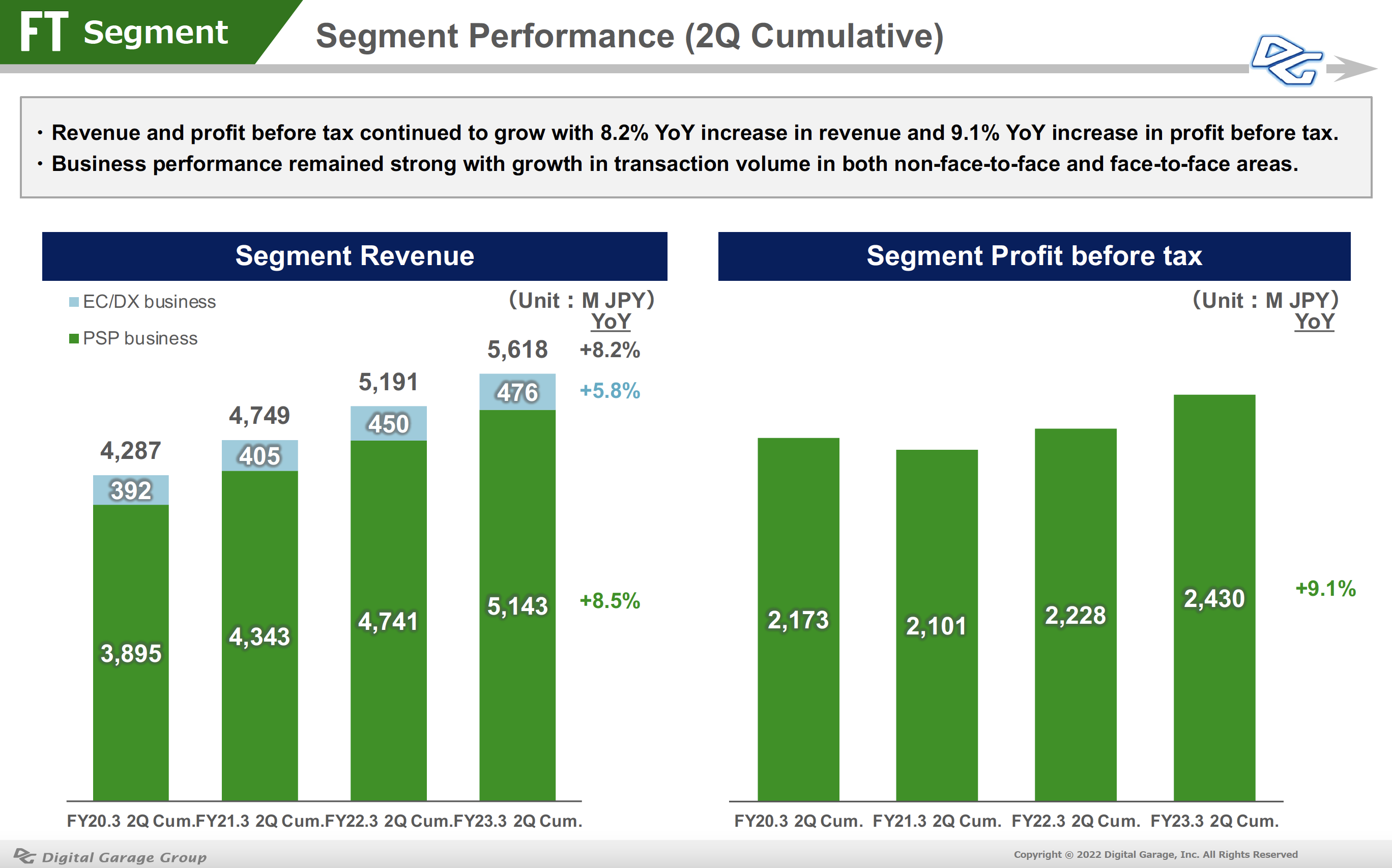

Cumulative 2Q revenue for the FT business was 5,618 million JPY (up 8.2% YoY), and profit before tax was 2,430 million JPY (up 9.1% YoY). Settlement transaction volume was 2,479.2 billion JPY (up 20% YoY), and the number of settlement transactions reached 463.19 million (up 22% YoY), achieving high growth of over 20%. Non-face-to-face settlement transaction volume was 1,876.7 billion JPY (up 14% YoY), while face-to-face settlement transaction volume, a focus of the Group, was 602.5 billion JPY (up 44% YoY). By industry, in addition to a recovery in the mainstay travel and entertainment facilities, the general retail sector, where the alliance strategy is proving successful, also saw growth.

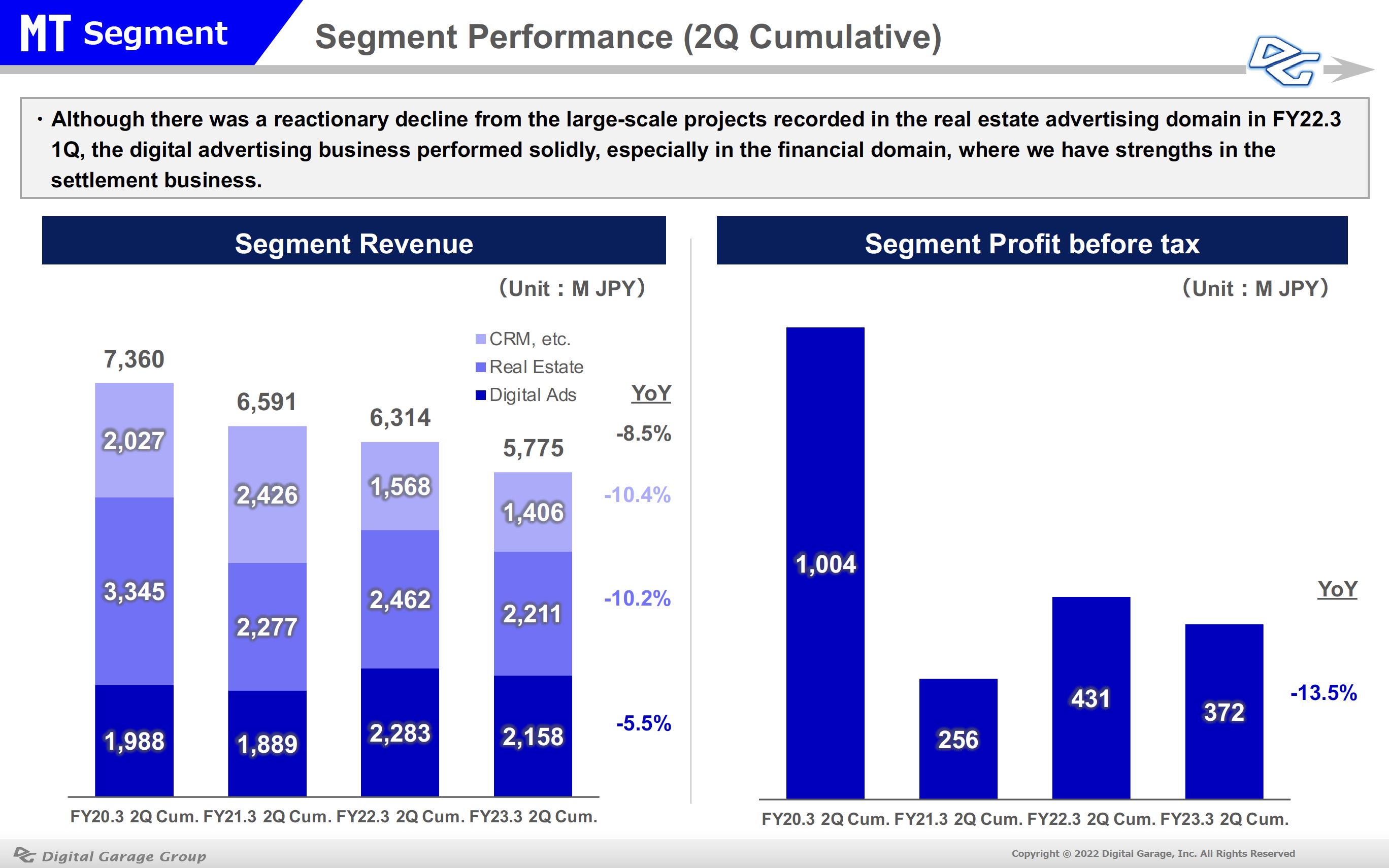

MT business posted 2Q cumulative revenues of 5,775 million JPY (down 8.5% YoY) and profit before tax of 372 million JPY (down 13.5% YoY). Profit before tax for the second quarter (Jul.- Sep.) was 272 million JPY (up 49% YoY), showing a recovery trend toward the second half of the year. Digital ad transaction volume, our mainstay business, was 15.5 billion JPY (down 2% YoY), of which our mainstay credit card and other finance-related transaction volume was solid at 9.4 billion JPY (up 2% YoY).

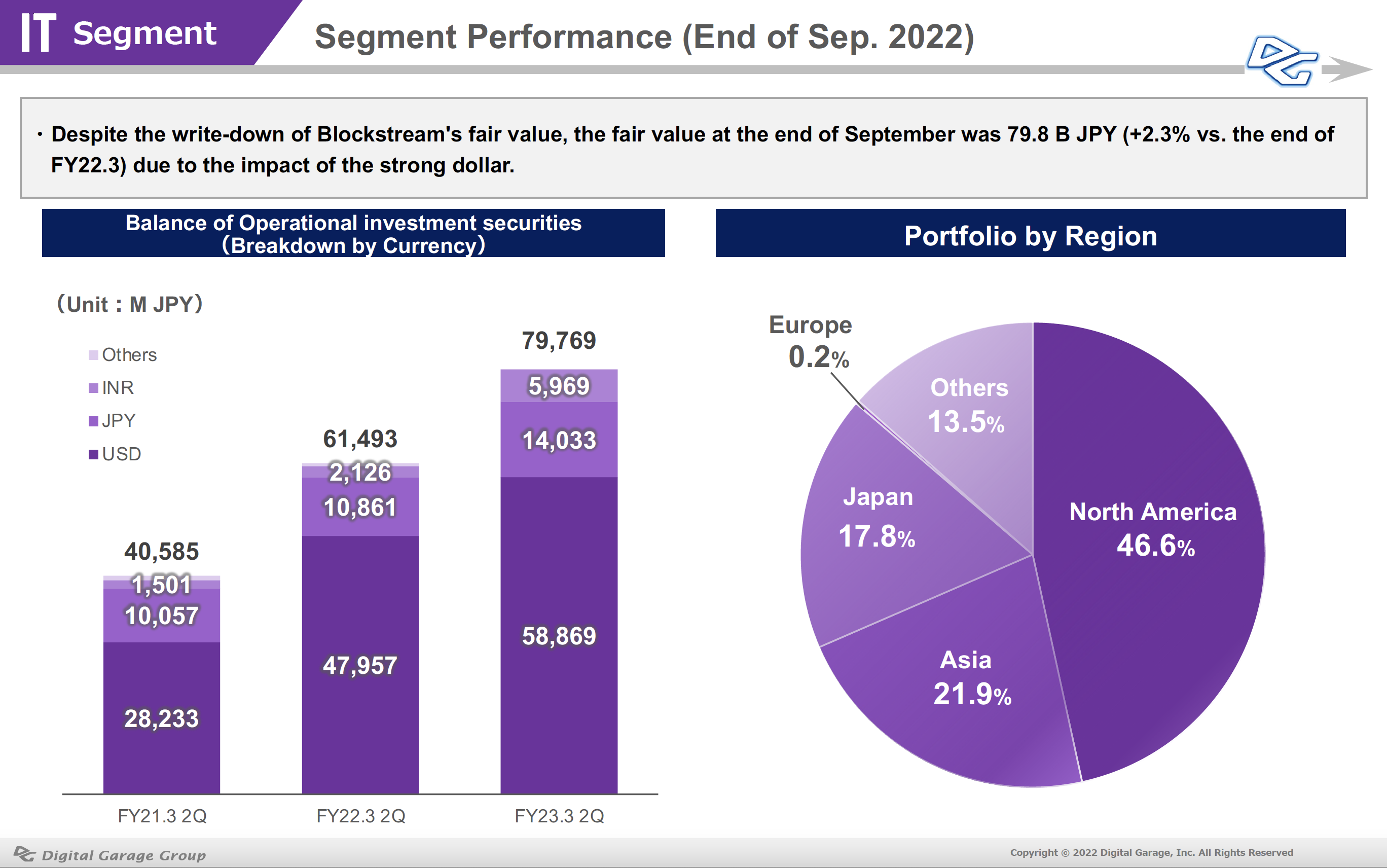

The IT business posted a 2Q cumulative revenue of -11 million JPY (-16,240 million JPY YoY) and a loss before tax of 963 million JPY (15,522 million JPY profit in the same period last year). Due in part to the aforementioned impact of Blockstream, the fair value balance of investees decreased from the end of the previous quarter, but remained stable at around 80 billion JPY.

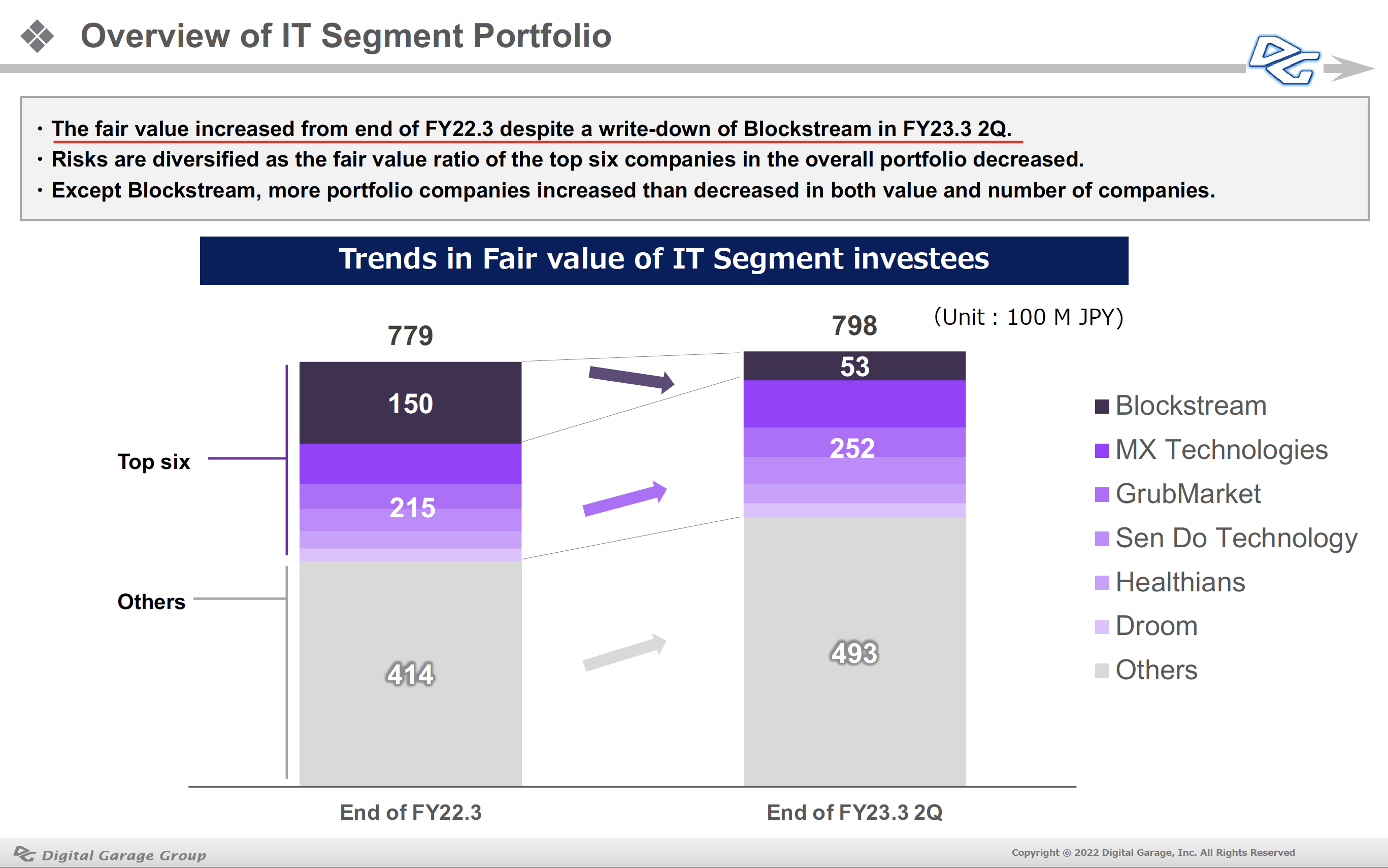

Please see “IT Segment – Segment Performance (End of Sep. 2022)” below. Also, The second slide, “Overview of IT Segment Portfolio,” shows a ratio of top 6 companies fair value in the portfolio; although a write-down of Blockstream was recorded in the 2Q, the overall fair value increased compared to the end of FY22.3.

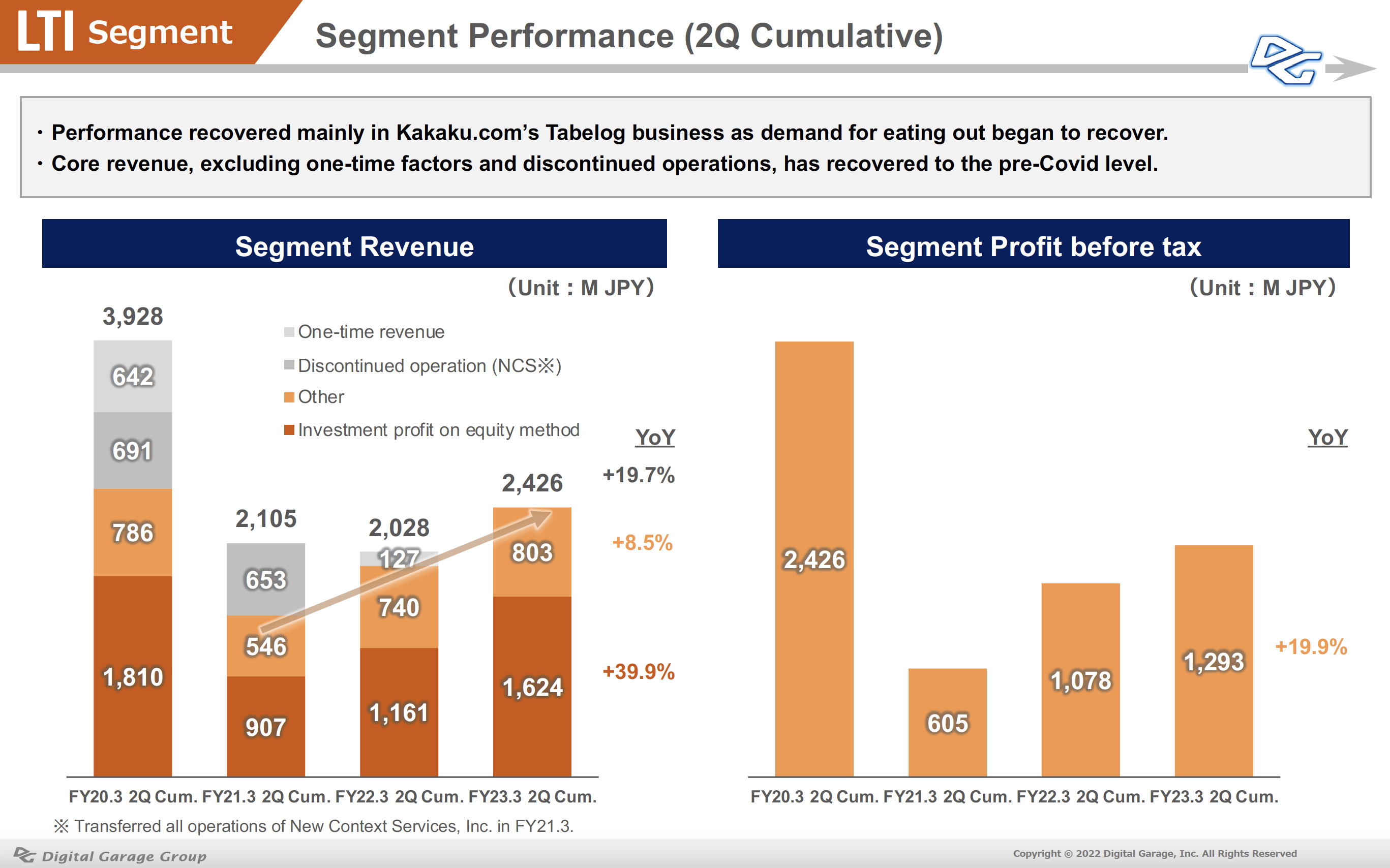

LTI business posted 2Q cumulative revenues of 2,426 million JPY (up 19.7% YoY) and profit before tax of 1,293 million JPY (up 19.9% YoY). Kakaku.com, Inc., an equity-method affiliate, is recovering from the impact of the spread of the new coronavirus infection as economic and social activities are normalizing, and the recovery of the Tabelog business and the Kyujin Box business are performing particularly well.

〜DG forms a strategic alliance with Resona Group and launches new services〜

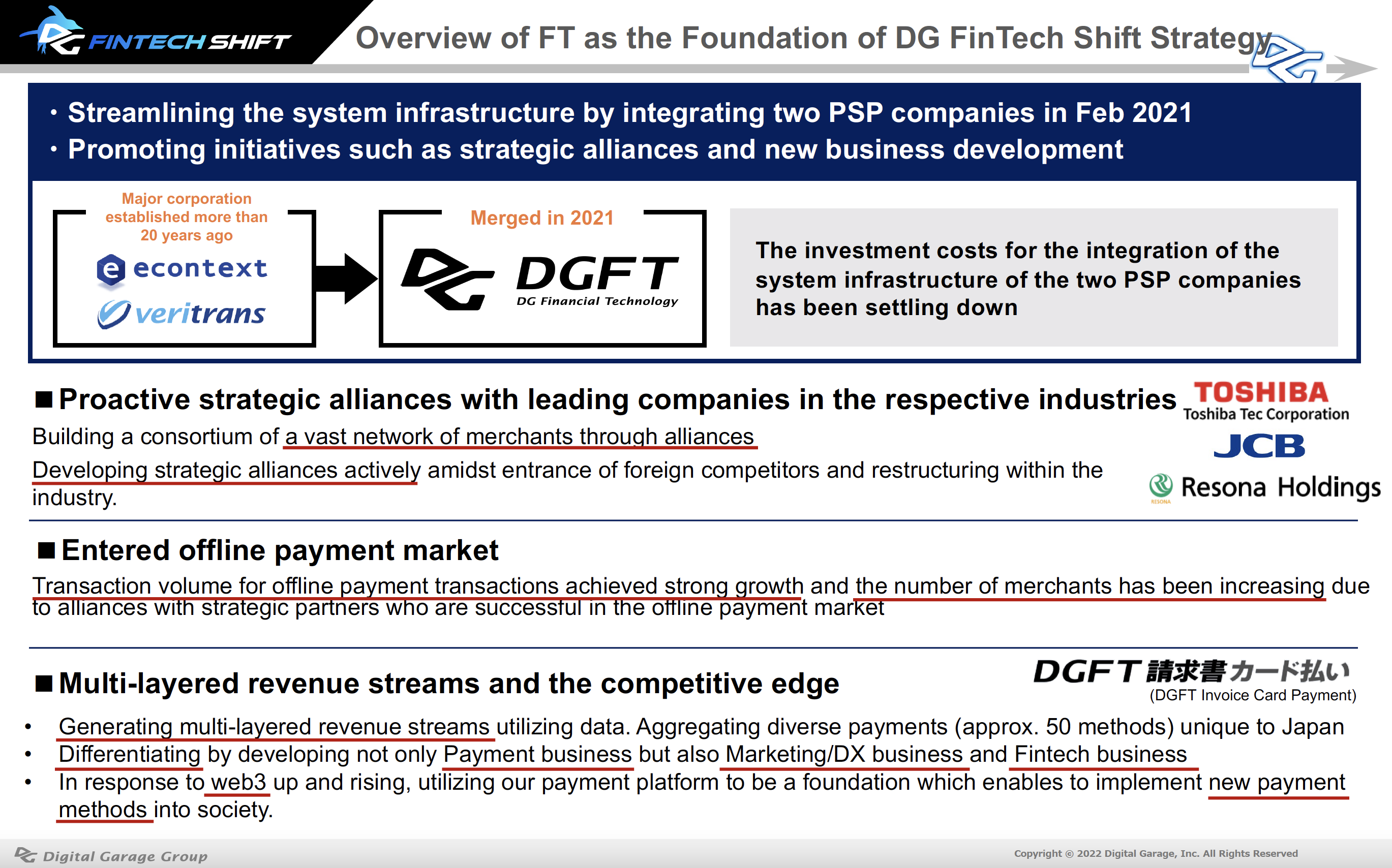

The two PSP operating companies, ECONTEXT and VeriTrans, were integrated in February 2021 and renamed to DGFT, and we have been working to streamline the system infrastructure as the focus of accelerating group growth.

We also accelerated the “DG FinTech Shift” initiatives with various strategic partners such as the following.

・Capital and business alliance with Toshiba Tec and co-promotion of cashless and DX in the retail market

・Capital and business alliance with JCB and integration of technology related to data and the next-generation Fintech

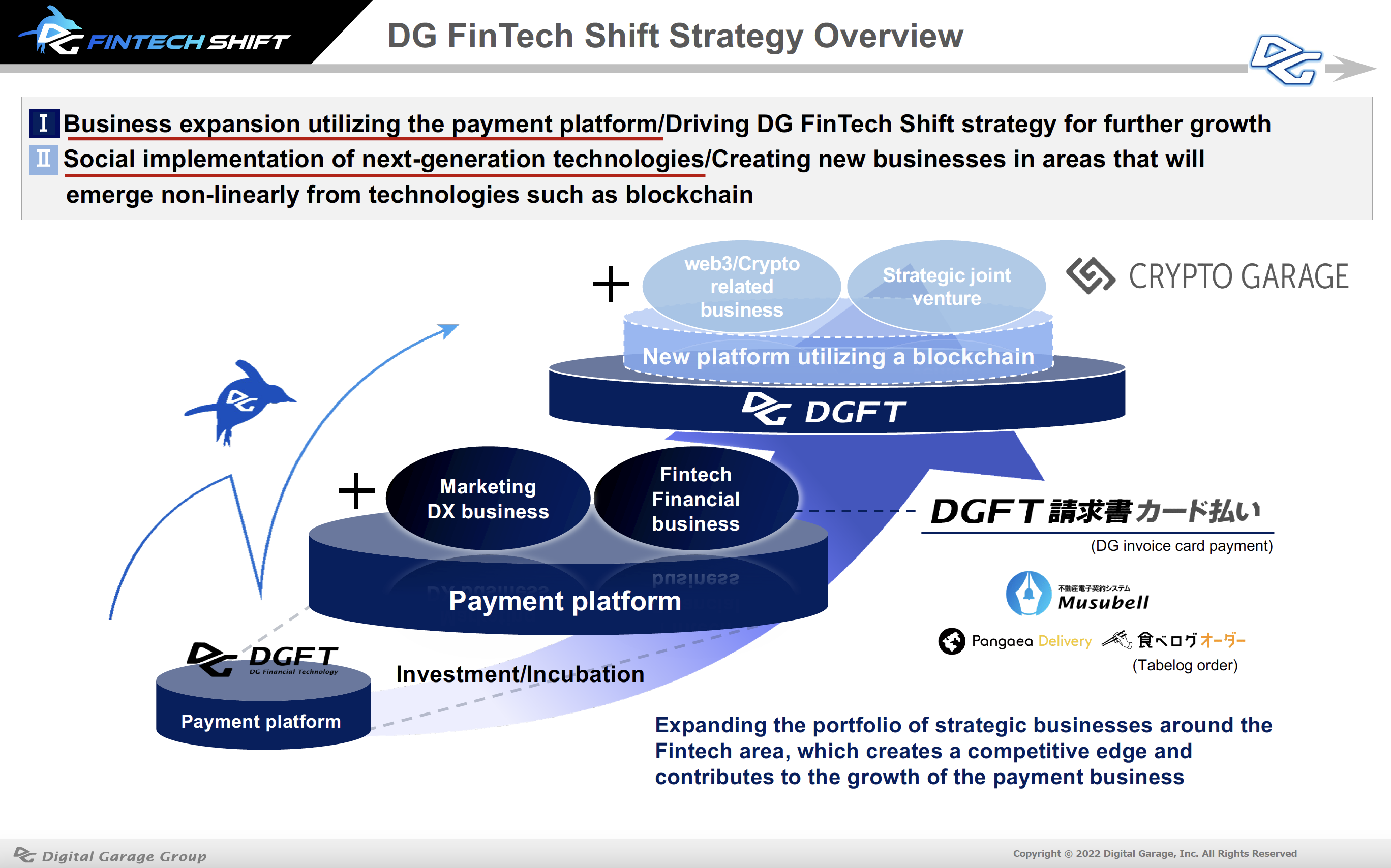

In addition to that, we have been promoting next-generation businesses by【Ⅱ】【Implementation of next-generation technologies and creation of new businesses using blockchain technology】, including Crypto Garage’s registration as a Crypto Asset Exchange Service Provider and capital and business alliance with Nomura Holdings to co-develop a crypto asset business platform. Thus, we are accelerating the “DG FinTech Shift” in the combination of 【Ⅰ】【Business expansion utilizing the payment platform】and【Ⅱ】.

The slide below is the outline of the “DG FinTech Shift.”

This slide shows an overview of the FT segment.

I would like to explain the initiatives of the “DG FinTech Shift.”

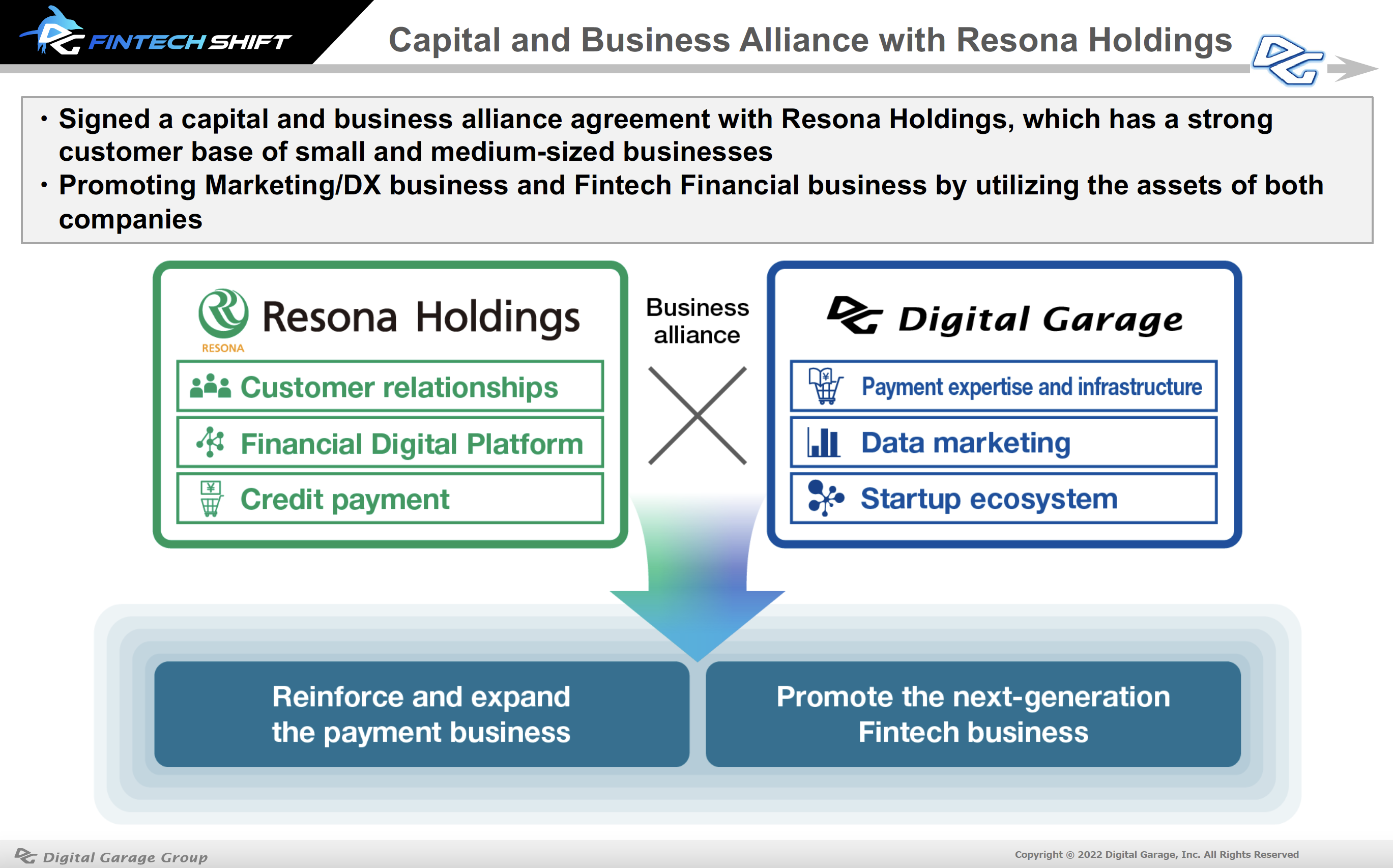

(1) Capital and business alliance with Resona

Today, we announced a “Capital and Business Alliance with Resona.” Almost 83% of Resona’s loans are to individuals and small and medium-sized business customers (SMB). Through the capital and business alliance with Resona, which has strong SMB customer relationships, the two companies will combine their data, next-generation Fintech-related technologies, and other assets to develop marketing and DX businesses and Fintech businesses to contribute to the promotion of DX.

The outline of the business alliance is as follows

・Provide payment services for E-Commerce

・Create new Fintech businesses such as high value add lending services utilizing new technologies and data

Details will be announced with the press release.

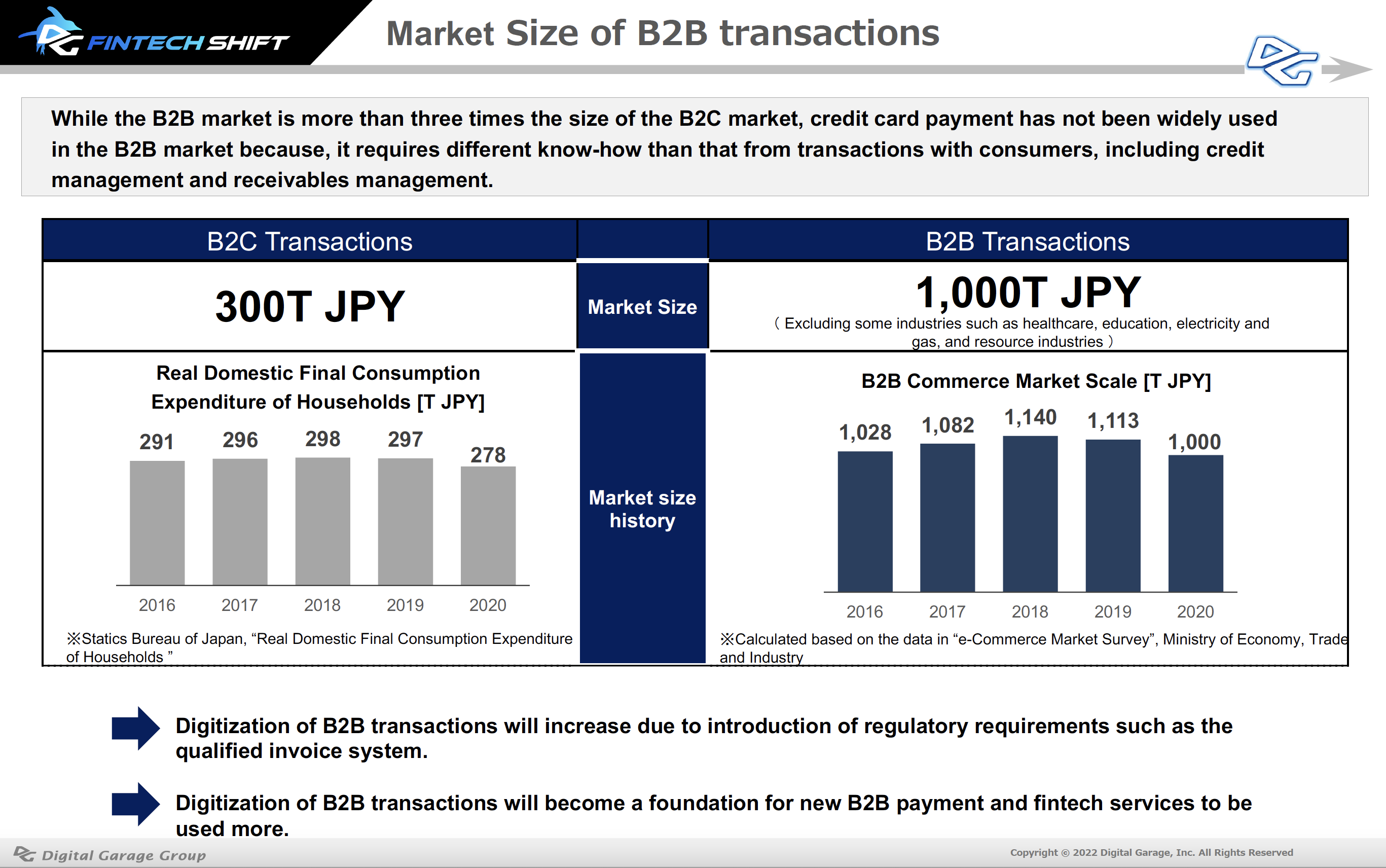

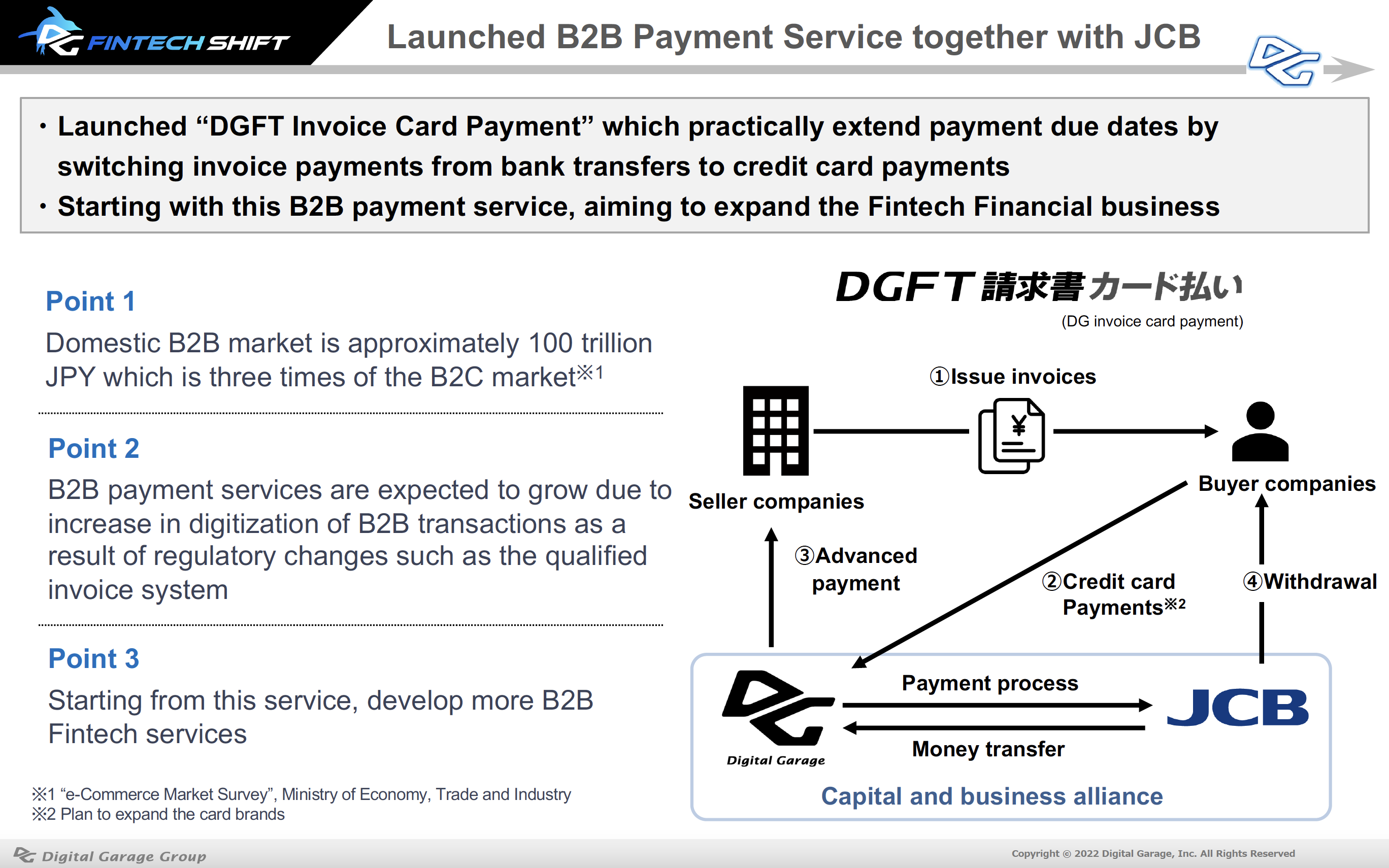

(2)Launched B2B payment service with JCB / DGFT Invoice Card Payment

DG Group has been in the B2C payment business for over 20 years. As a result, the business has grown to offer approximately 50 payment options, enabling payment at 880,000 locations in contactless and in-store business areas, with an annual payment processing volume of over 4.4 trillion yen. The B2B market we are entering is enormous, with a size of 1,000 trillion yen, more than three times that of B2C. The introduction of the qualified invoice system, which will begin in October 2023, will also boost this market.

With the evolution and development of DX from various perspectives, services previously unavailable in the U.S. and Europe are now beginning to open up new markets through Fintech startups. Card payment for invoices is also becoming a growing market worldwide. Melio was established in 2018 and reached a valuation of $4 billion at the time of its recent fundraising, and Plastiq announced plans to go public in August 2022 using a particular purpose acquisition vehicle (SPAC). We have been an early investor in iPaymy, Singapore’s first one-stop corporate payment management service in Asia.

This initiative with JCB is a B2B payment service in Japan that merges the credit card platform with DG Group’s expertise in payment and data. The service is called “DGFT Invoice Card Payment.” We aim to become the de facto for B2B services matching the Japanese market structure and individual needs of businesses by supporting cash management and business efficiency for individual and SMB customers. To start with, the B2B payment service will be launched for JCB brand credit cards and will be expanded to all brands, including Visa and Master.

Please see the following slides to learn more.

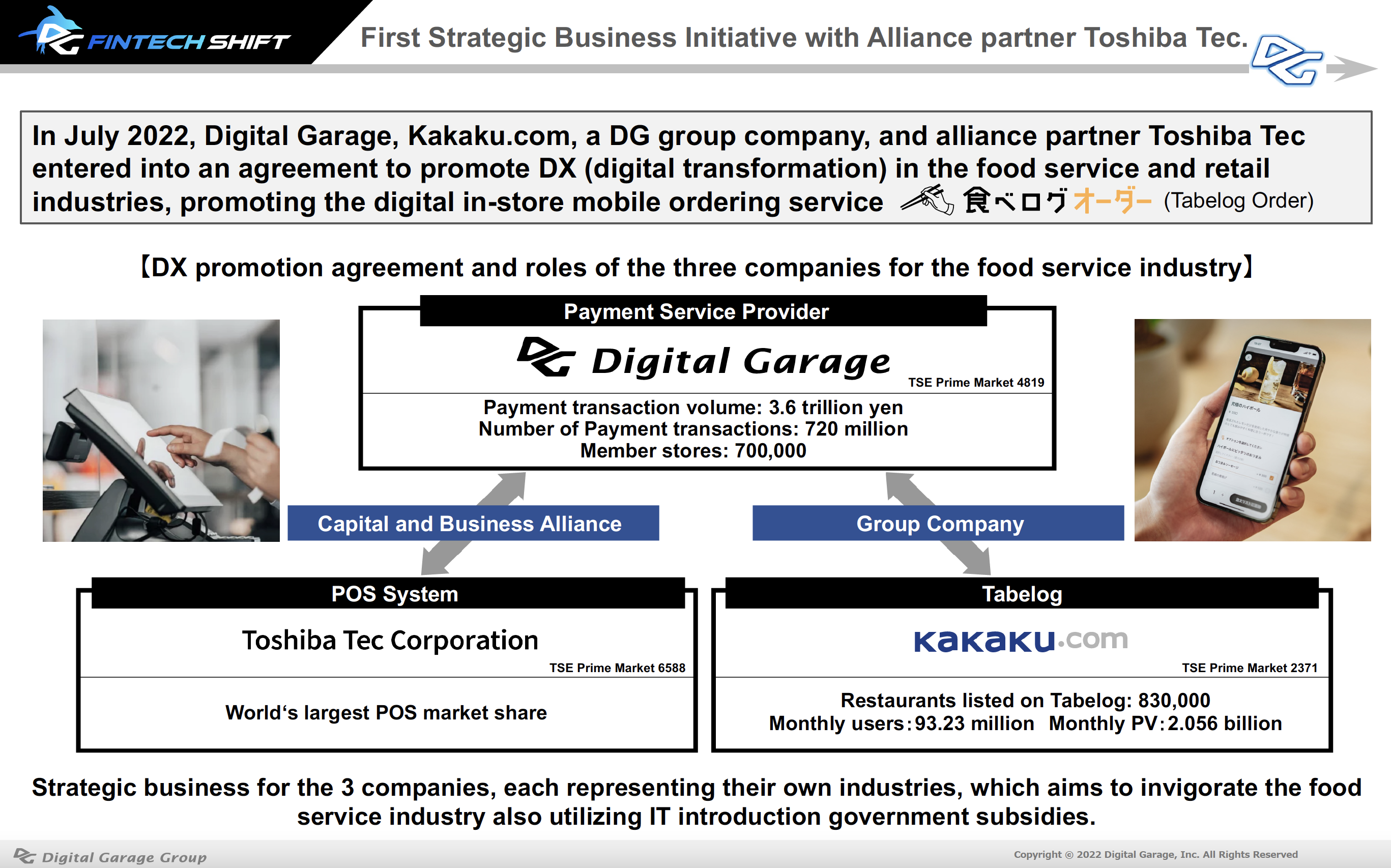

Signed LOI to promote DX in the food service, and retail industries with Kakaku.com and Toshiba Tec / “Tabelog Order”

DG Group signed a basic agreement in July with Toshiba Tec and the DG group company Kakaku.com to provide strategic support for “Tabelog Order” and started promoting DX in the food, beverage, and retail industries. Specifically, the project will combine Toshiba Tec’s POS system with DG’s payment services, allowing consumers who use “Tabelog” merchants to use their smartphones as a gateway to various services. The “IT Introduction Subsidy 2022” promoted by the Ministry of Economy, Trade and Industry (METI) is an administrative program to solve the situation that the food service industry is facing, and this agreement between the three companies is designed to carry out initiatives from the private sector to provide Japan’s leading optimal solution for the industry.

Please check out the slides of the three companies’ initiatives below.

※Excerpted from FYE March 2023 First Quarter Financial Report

As indicated by the establishment of the Digital Agency, a big wave of digitalization is about to come to Japan, as the leading developed countries. For the past 20 years, we have been aligning our payment (FT) and marketing (MT) businesses, and the various investments (IT) that leverages our global network. We will continue to work with stakeholders to advance the “DG FinTech Shift” strategy. We will also look forward one step into the future through R&D activities in next-generation technologies.

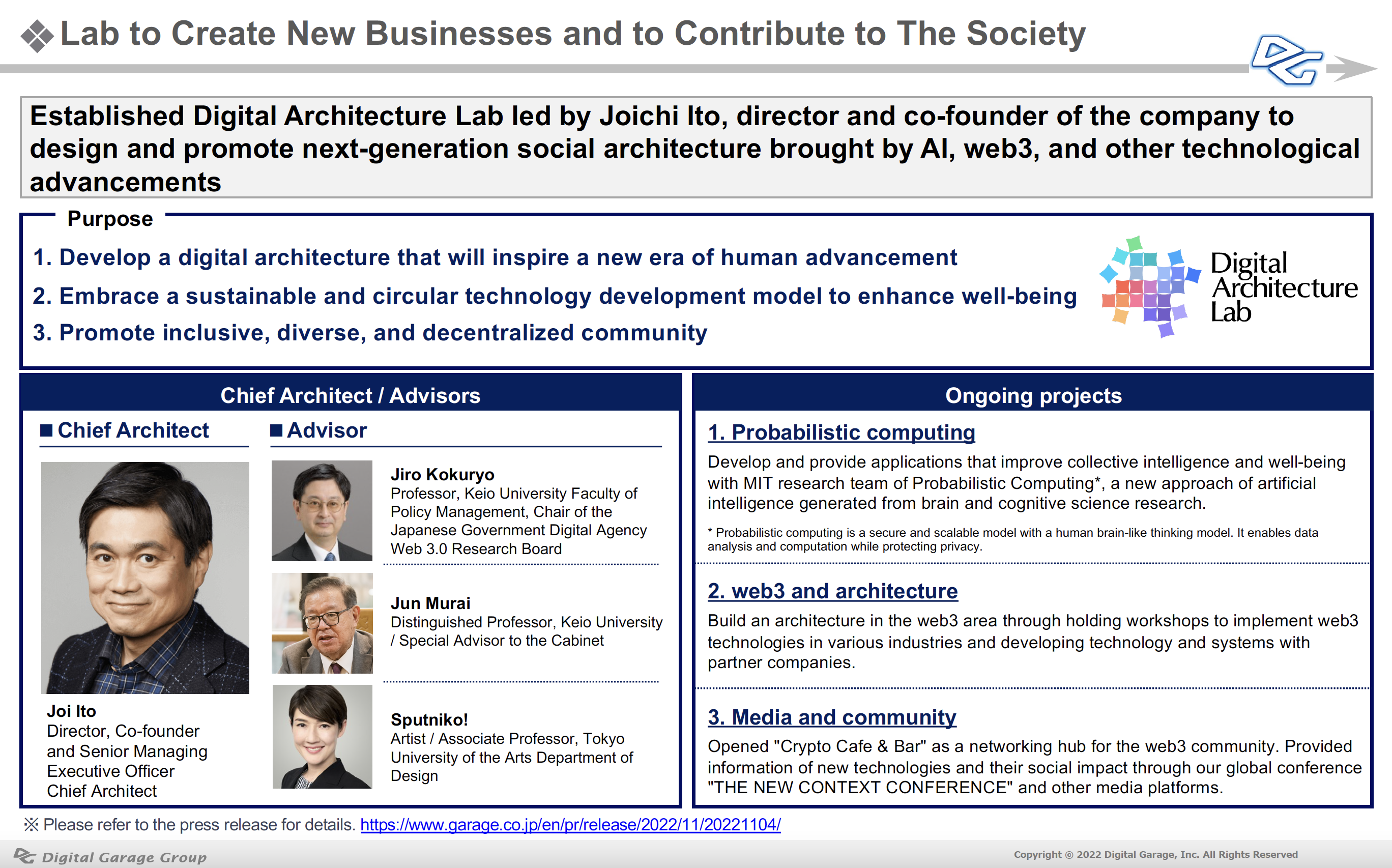

As a company designing “new context,” the DG Group has evolved along with the digital transformation of society and has developed various services in line with the evolution of technology, including publishing Japan’s first personal homepage. Now the web3 era is about to begin. Japan is trying to lead other developed countries with web3 in its national strategy. As a global citizen and a member of the global Internet community, we will lead the global community by implementing next-generation technology into society with the lab led by Joichi Ito, Director, Co-Founder, Senior Managing Executive Officer and Chief Architect of DG.

(1)Established Digital Architecture Lab to design the social architecture of next-generation https://dalab.xyz/en/

The Digital Architecture Lab was established with Joichi Ito and experts in designing digital architecture as advisors. We set three themes to promote the implementation and design of next-generation social structures brought about by the evolution of next-generation AI, web3, and other cutting-edge technologies.

■Advisors

・Kokuryo, Jiro (Professor, Keio University Faculty of Policy Management, Chair of the Japanese Government Digital Agency Web 3.0 Research Board)

・Jun Murai (Distinguished Professor, Keio University/“Father of the Japan’s Internet” )

・Sputniko! (Artist / Associate Professor, Tokyo University of the Arts Department of Design)

Please see the following slides in detail.

Lawrence Lessig, an U.S. attorney, suggests that a comprehensive understanding of the four elements of “culture,” “law,” “economics,” and “technology” can lead to the right context and build a new era of technology. Lights and shadows still exist together in web3. We are confident that amendments in regulations based on Japan’s national strategy and the proper guidelines will result in a Digital Architecture that will build the next-generation of global Internet community.

Please see the concept movie of Digital Architecture Lab

(2)Hosting THE NEW CONTEXT CONFERENCE under the theme of “Designing Our New Digital Architecture”

We hosted “THE NEW CONTEXT CONFERENCE” for the second time this year since June. This was the 23rd conference since 2005, with the theme “Designing Our New Digital Architecture.” We invited Lawrence Lessig, Professor at Harvard Law School, Pplpleasr, a leading NFT artist, and other experts to discuss the architecture of future society.

Please see the highlights and archive video

(3)Launched onlab web3

We launched onlab web3, which supports web3 startups that want to expand their business overseas or enter into Japan markets with experts. A global pitch event was held in November with eight startups from Japan and overseas selected from a number of applicants, and we will continue to prepare a variety of support by leveraging our global network.

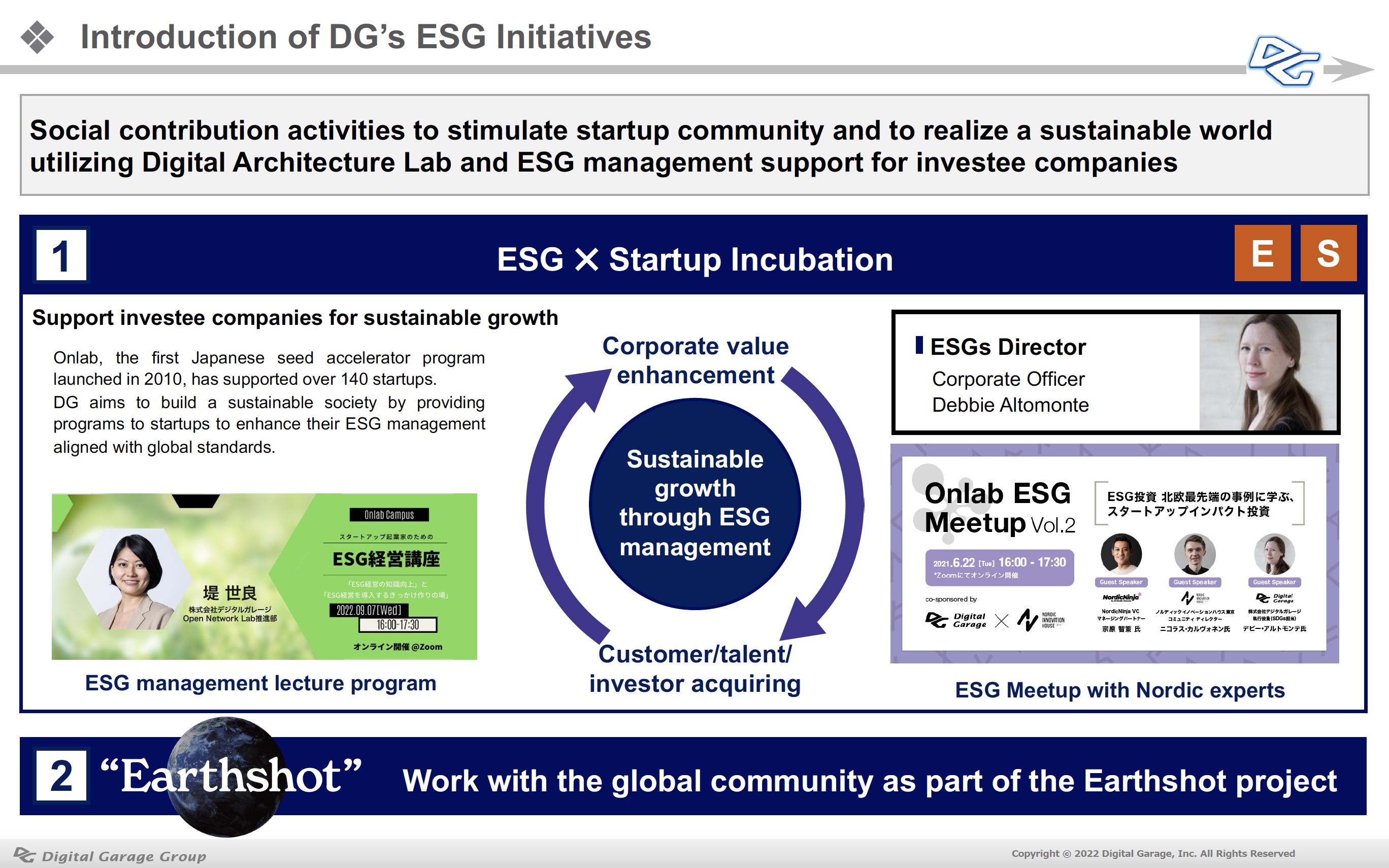

〜Programs for startups to support their ESG social implementation〜

Attention to ESG activities has been increasing in Japan recently and startups need to take actions to become the “chosen and attractive company” especially for fundraising and recruitment. However, venture capital and accelerator programs offer few educational opportunities for startups for that. The DG Group, which has been supporting startups for many years, was one of the first to leverage its overseas network to support ESG management and sustainable business growth for startups by introducing advanced ESG case studies and workshops. In 2019, we appointed a corporate officer dedicated to ESG to implement an ESG management program on a global scale. DG will continue to contribute to building a sustainable society on a large scale.

Please see the following slides to learn more.

Please watch the concept video for “Earthshot,” which will be played at Ryuichi Sakamoto’s concert in December. This video introduces a message from Ryuichi Sakamoto about “Earthshot” with the music “DG25,” an original track written for us.

Lastly, DG intends to keep the concept of “Ambidexterity” in our mind which has two aspects, “defense, deepening existing businesses” and “offense, creating new businesses,” and continue contributing to creating a sustainable society based on our corporate purpose of “Designing ‘New Contexts’ for a sustainable society with technology.”

We look forward to the continued support and encouragement of our stakeholders, including our shareholders.