DG Mail

DG Mail is an online magazine that provides you with the latest news from the Digital Garage Group.

If you would like to subscribe to DG Mail, please fill out the form.

Designing

New Context

Designing

New Context

CEO Comment Vol.81 “FYE March 2024 Financial Report Summary”

Also concluded a business alliance agreement with KDDI Group (au Financial Service) in the payment domain, as well as with Resona Group.

With the approval of the Board of Directors today, we have announced FY24.3 financial results (IFRS).

As for the consolidated business results for the fiscal year ended March 31, 2024, revenue was 37,853 million JPY (+25.9% YoY), and profit before tax was 6,298 million JPY (loss of 13,881 million JPY in the previous fiscal year). DG Group’s core payment business achieved more than 15% profit growth. Additionally, in the Long-term Incubation segment, which consists of the equity method profit of Kakaku.com, Inc. and new businesses, Kakaku.com’s solid growth led to 16% stable growth in the segment profit excluding one-time factors. As a result, DG achieved significant profit growth, including the rebound from the previous year’s fair value evaluation losses on investments. In the Global Investment Incubation segment, steady progress in portfolio sales and fund distributions resulted in an investment income of 5.6 billion JPY.

Let me explain the essence of the business strategy and highlights of DG Group’s businesses for FY24.3 and FY25.3.

【Platform Solution(PS) Segment】In FY24.3, the first year of the Medium-term Plan, our core payment business achieved more than 15% profit growth due to the convergence of COVID-19 and successful alliances with strategic partners.

In terms of the “basic business P&L,” which represents recurring business revenue and profit excluding investment-related and one-time gains/losses, the Group’s business base has been steadily growing with stable profit growth. In response to changes in the global business environment, including the consumer economy, technological advances, and regulations, we have been promptly taking internal and external actions to “optimize the Group’s business structure.” Following Toshiba Tec, the leading POS provider, and JCB, which operates a credit card business, we expanded the capital and business alliance with a strategic partner, Resona Holdings, which has one of the largest client bases in Japan, mainly SMEs, to accelerate cooperation in the field of payment and next-generation Fintech.

As announced today, DGFT and au Financial Service of KDDI Group signed a business alliance agreement in the field of payment. With the KDDI Group’s foundation based on telecommunications and finance, the two companies will “co-create” a collaboration to provide next-generation, high-quality payment services for the au economic territory. To date, we have already collaborated with KDDI on the R&D project DGLab, investment and co-investment in the DGLab fund. For the future, we are considering collaboration in web3 (cryptocurrency area), the global startup community DG717 based in San Francisco, and joint research on next-generation AI.

In order to strengthen the enabling business group in FT, we established “DG Commerce” by acquiring the EC construction division of a leading vendor, System Integrator Corp. With DG Commerce, we reinforced the structure to support the entire EC business from a technology perspective, including relative businesses (EC, security, operation and monitoring in Japan and overseas, etc.). We also announced today the acquisition of SCORE. Co., Ltd. as a wholly owned subsidiary and the consolidation of FEELIST Inc., a leading system developer based in Sapporo, Japan, into our group.

From a group optimization perspective, MTC (Marketing) in the PS segment will continue to evolve into a “data-driven, high-functioning marketing group” in line with the changing regulation of personal information.

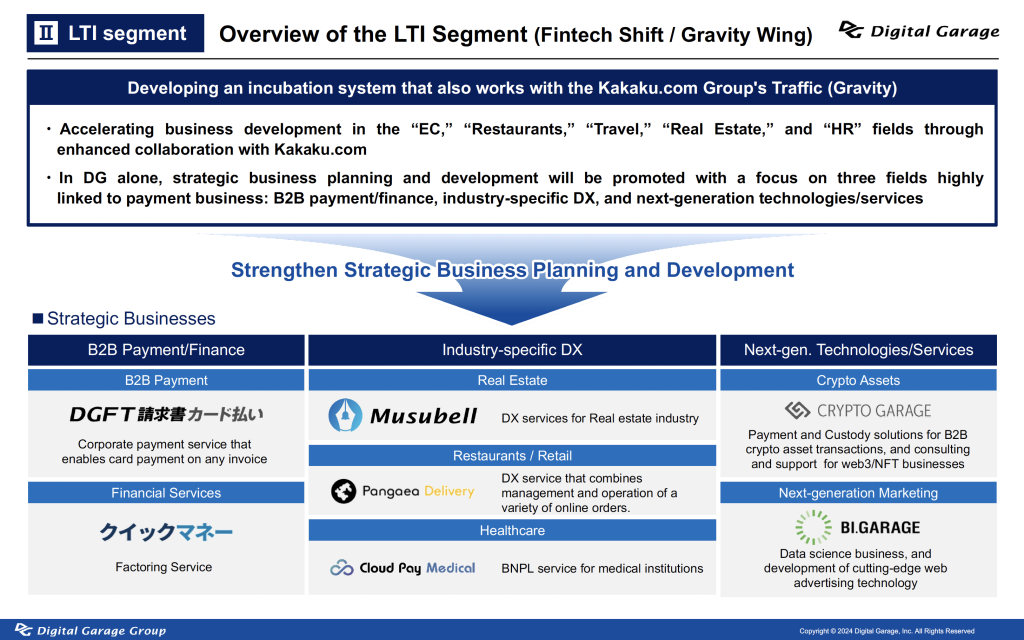

【Long-term Incubation (LTI) segment】 While working with Kakaku.com’s Tabelog, Kakaku.com, Kyujin Box, travel sites, and other traffic, we developed an ambidextrous structure to achieve continuous growth in FT and to create non-linear growing businesses driven by technology from three angles: “B2B payment/financial business”, “industry-specific DX”, and “next-generation technology.”

【Global Investment Incubation (GII) segment】We will invest in and nurture next-generation technologies such as AI and blockchain, as well as Fintech and data-related startups on a global scale through the “Global Incubation Stream” developed over the years. In particular, for the Generative AI field, we launched a startup studio in San Francisco, which has become a center for advanced technology and service development with the participation of 300 startups from around the world. In addition, we are shifting to a fund-based investment style and will design and implement volatility conscious management with investment securities over the medium term.

Below is the slide presentation of the “Financial Highlights” for the fiscal year ended March 31, 2024.

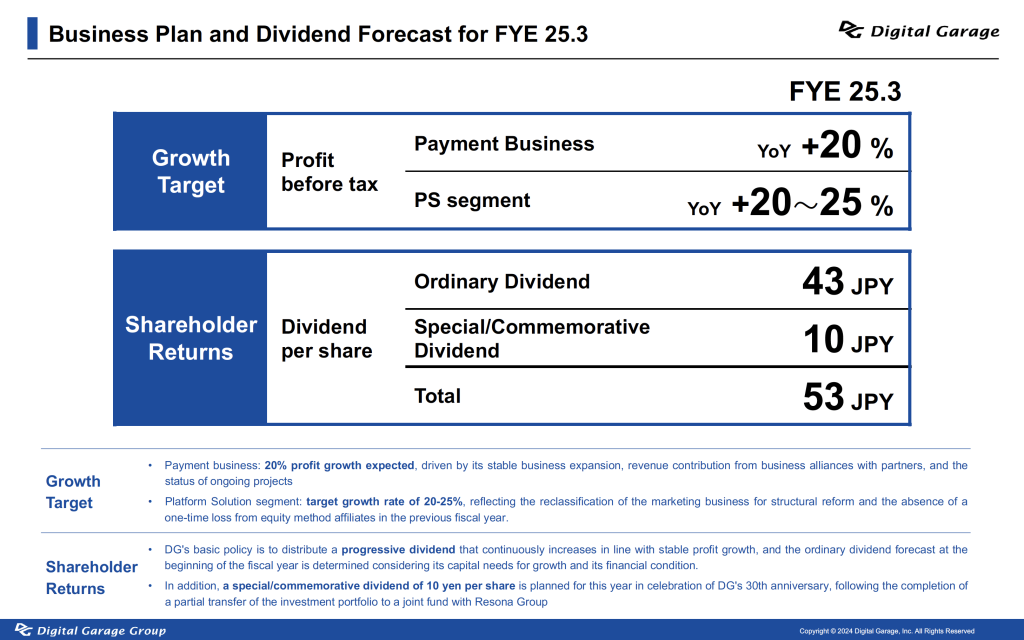

As a target for the fiscal year ending March 31, 2025, the second year of the Medium-term Plan, we set a pre-tax profit growth rate of 20% for the payment business.

Given the government-led promotion of cashless transactions and other favorable external conditions, this is an achievable target with expected profit contributions from alliances and various measures taken to date, as well as the launch of new initiatives, which I will explain later in this presentation. We have also set the growth rate target for the entire PS segment at 20-25%. In the marketing business, which has been integrated with the payment business, we will continue to transform the business structure, including the reclassification of earnings, as the second phase of optimization to enhance integration with the payment business. Therefore, we disclosed the target in a range. As there was a temporary loss from equity method affiliates of the marketing business in the previous period, we anticipate a higher growth rate.

Furthermore, since stable and continuous growth in basic business profit is expected, we decided to disclose a dividend forecast at the beginning of the fiscal year. For the current fiscal year, we announced the ordinary dividend forecast of 43 yen, an increase of 3 yen from the previous year. In addition to the investment results expected in the current fiscal year, we plan to distribute a special commemorative dividend of 10 yen per share to show appreciation for the 30th anniversary of DG’s founding.

Next, I will explain the measures we will take to achieve our growth targets for the fiscal year ending March 31, 2025 and beyond.

The following is a report on the DG Group’s growth strategy for FY25.3, the second year of its Medium-term Plan, and beyond.

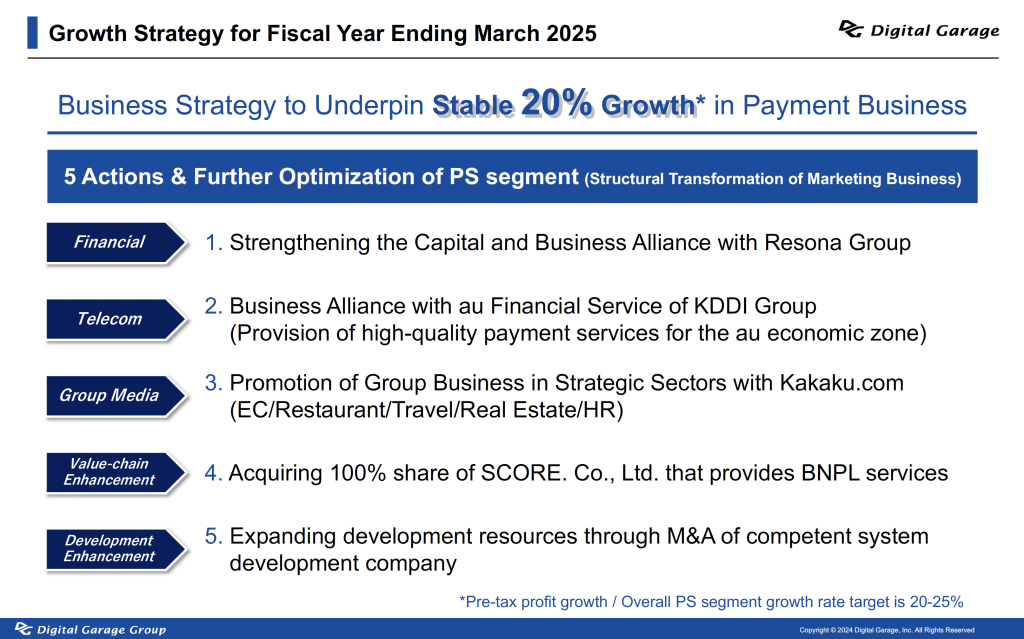

We are taking various actions in each domain to expand our business. In the financial domain, we formed a capital and business alliance with the Group; in the telecommunications domain, we formed a business alliance with au Financial Service; and in the media domain, we collaborated with Kakaku.com. A decision was also made to make SCORE. Co., Ltd. (SCORE), a post payment business joint venture, a wholly owned subsidiary to strengthen the payment business in the value chain, and to make a leading system development company based in Sapporo a member of the group to improve its development capabilities. Along with these strategies, we will further optimize the PS segment and transform the structure of the marketing technology domain.

※Aim for pre-tax profit growth (total PS segment growth) of 20-25%.

Please refer to the following slides.

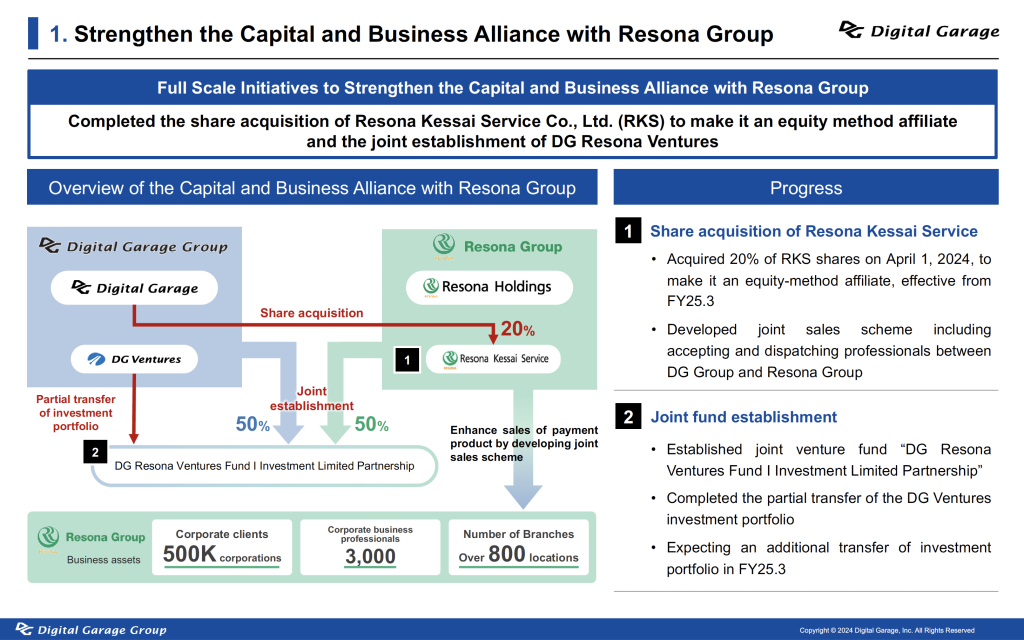

We started strengthening our capital and business alliance with Resona Group, one of our strategic partners. As part of this effort, we acquired 20% of the total outstanding shares of Resona Kessai Service Co., Ltd. (RKS), making it an equity-method affiliate of Digital Garage. RKS offers various financial solutions, including factoring, guarantees, and payment collection services that handle 50 million cases annually. Through the exchange of employees between the two groups and the provision of DG Financial Technology‘s advanced solutions, the two groups will establish an integrated sales structure for payment services to the 500,000 corporate customers of the Resona Group, thereby strengthening the payment business of the two groups.

In addition, we established DGRV (DG Resona Ventures Fund I Investment Limited Partnership), a CVC fund with a total value of 13 billion yen that the two groups will jointly manage. We focus on open innovation through startup investments and aim to jointly drive it by leveraging the knowledge DG has cultivated through its experience supporting numerous startups.

Please refer to the following slide regarding the capital and business alliance with Resona Group.

DG Financial Technology and KDDI Group’s au Financial Service formed a business alliance to collaborate in the payment business.

In addition to jointly expanding DGFT’s high-quality payment services to the wide au economic territory, including the KDDI Group’s telecom services and e-commerce business, we will promote the joint development and rollout of new businesses, utilizing the resources of telecom carriers and looking beyond the au economic territory. With this alliance, we aim to expand our market share and improve our industry positioning in the growing cashless market.

Please refer to the following slide regarding the business alliance with au Financial Service.

DG specifies “e-commerce,” “Restaurant,” “Travel,” “Real Estate,” and “HR” as the Group’s strategic collaboration sectors among the various Internet media developed by Kakaku.com and will create Group business collaboration in these areas with payments as the starting point.

Developing a group data infrastructure based on the above strategic sectors is in progress. Furthermore, we will drive joint development of new services and R&D activities using next-generation AI, especially with our capital and business alliance partners.

Please see the slides below regarding the Overview of the Project.

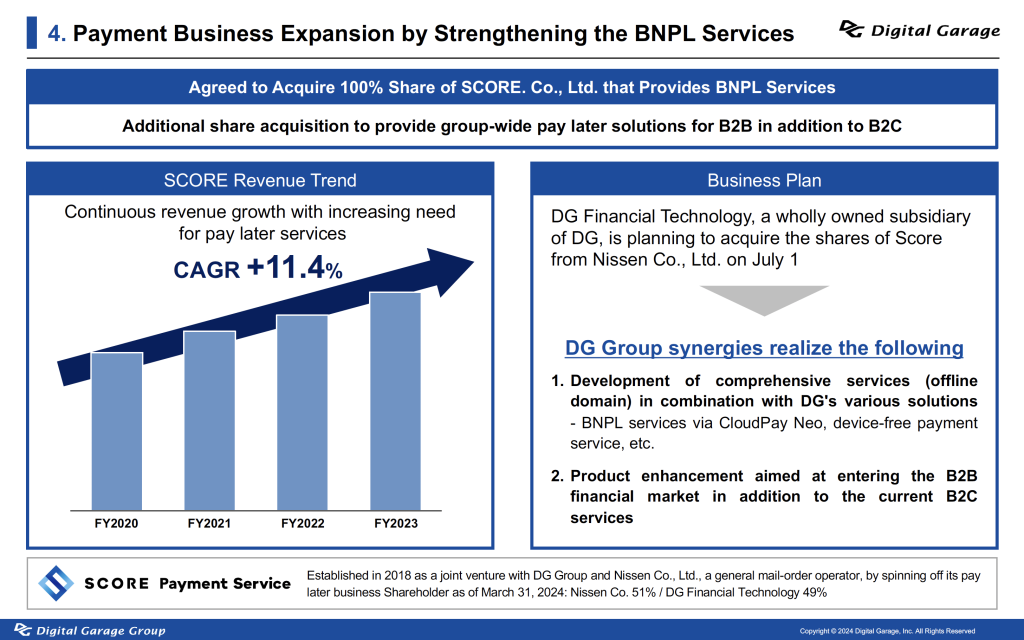

Post payment services are gaining recognition as an important payment method, especially among younger consumers who do not have credit cards and middle-aged and older consumers who value the peace of mind that comes with online payment. Due to the expansion of the usage environment and higher payment unit prices, the market size is expected to grow to approximately 2 trillion yen by FY2026.

DG Financial Technology will acquire shares of Nissen Co., Ltd. in SCORE, a post payment business joint venture, to strengthen our approach to the post payment service market. We will enhance our products by bringing system development in-house, providing comprehensive services by combining them with various DG Group solutions and promoting initiatives that leverage group synergies intending to enter the B2B domain.

Please see the following slide regarding expanding the payment business by strengthening the post payment area.

The DG Group is working to improve its technology platform in payment systems, new products, and advanced technology. As part of this effort, we will integrate FEELIST Inc. (FEELIST), a development company based in Sapporo, into our group.

As an important social infrastructure, payment systems must operate stably 24/7 and have robust security. In addition, we believe that reinforcing development resources is an essential for the DG Group’s growth, such as promoting DX and Fintech transformation in various industries, developing next-generation products, developing technologies in the GenAI and crypto asset domains, and utilizing cutting-edge technologies in our business through collaboration with Digital Architecture Lab.

The FEELIST is scheduled to join the DG Group on July 1, 2024, expanding the DG Group’s development structure to approximately 500 people. Including M&As such as this one, we will further expand our technology platform and promote the training of engineers to achieve early monetization of new businesses and improve competitiveness.

Please refer to the following slides regarding expanding the Digital Garage Group’s development resources.

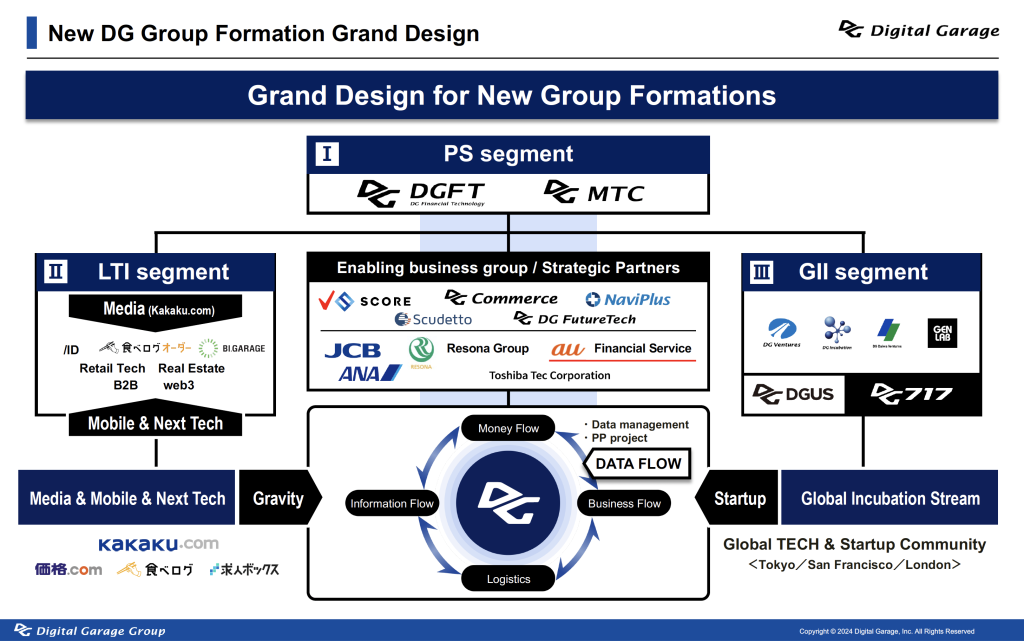

A new Group Formation Grand Design has been created to provide an overview of each segment strategy in the new fiscal year.

In particular, in the PS segment, management resources will be concentrated on the “Enabling Business Group” to consolidate revenues with payments as the central monetization point and to form a more evolved “DG Economic Territory” through collaboration with strategic partners. At the same time, we will enhance collaboration between Kakaku.com and new business groups in the LTI segment, which provide services aligned with issues in various industries. This will be combined with the “global incubation stream” that DG has built up to create a global, industry-wide data analysis infrastructure based on payments, aiming to accelerate the data flow of money, commerce, logistics, and information flows.

Please see the Group Formation Grand Design slides below.

Please find below an overview of the PS segment and the Enabling business group.

Since we established DG Commerce in December 2023 by incorporating the e-commerce website construction business of a System Integrator into our own group, the DG Group’s strategy, “DG FinTech Shift,” has been accelerating. The DG Group is expanding beyond being a payment provider to an ecosystem that supports digital commerce entirely. By strategically focusing group resources on digital commerce, we have improved our structure and capabilities to expand payment revenues.

We will also foster a group of strategic businesses that leverage the Gravity (traffic) of the Kakaku.com Group, the core business of the DG Group’s LTI segment. Plus, we will leverage the global startup community in the GII segment to implement next-generation technologies.

With the new partnership with the KDDI Group, KDDI’s membership base will be combined with DG Commerce and other commerce-enabling business groups to expand the payment business. Also, by positioning and focusing on areas such as logistics collaboration and unified commerce as data-enabling domains, we will connect these to data utilization, aiming to achieve multi-layered monetization of data.

Please see the slides below for the PS Segment and Enabling Business Group Overview.

The LTI segment is a business segment that engages in the planning, developing, and nurturing strategic businesses, including Kakaku.com, that are expected to become the future core businesses of the Group. We are pursuing initiatives in the three areas of “B2B Payment/Finance Business,” “Industry-specific DX Business,” and “Next-generation Technologies/Services,” which are highly compatible with our core payment business. To strengthen cooperation with Kakaku.com, we will assign executives in charge to both companies to facilitate the establishment and expansion of the Group’s business base in the “e-commerce,” “Restaurant,” “Travel,” “Real Estate,” and “HR” domains.

Please refer to the slides from the LTI Segment Overview below.

The GII segment invests in and nurtures startups globally.

We will strengthen our network to foster and invest in startups globally.

Although investment in the European region has been limited to date, a London office has been established, and Hiro Tamura, a leading European investor, has joined DG’s global incubation stream as the next addition to the team. We will promote strategic collaboration with the European startup ecosystem and each other with these structures. Also, we will strengthen our focus on the West Coast area of the U.S., where we have been working for a long time. “GenLab,” a STARTUP STUDIO specializing in Generative AI, was co-founded in San Francisco with core members of Silicon Valley’s inner circle.

This expanded global network will be connected to startup investments, aiming to develop the DG Group not only in terms of investment profits but also in the implementation of cutting-edge technology into Fintech businesses.

Please see the slides from the GII Segment Overview below.

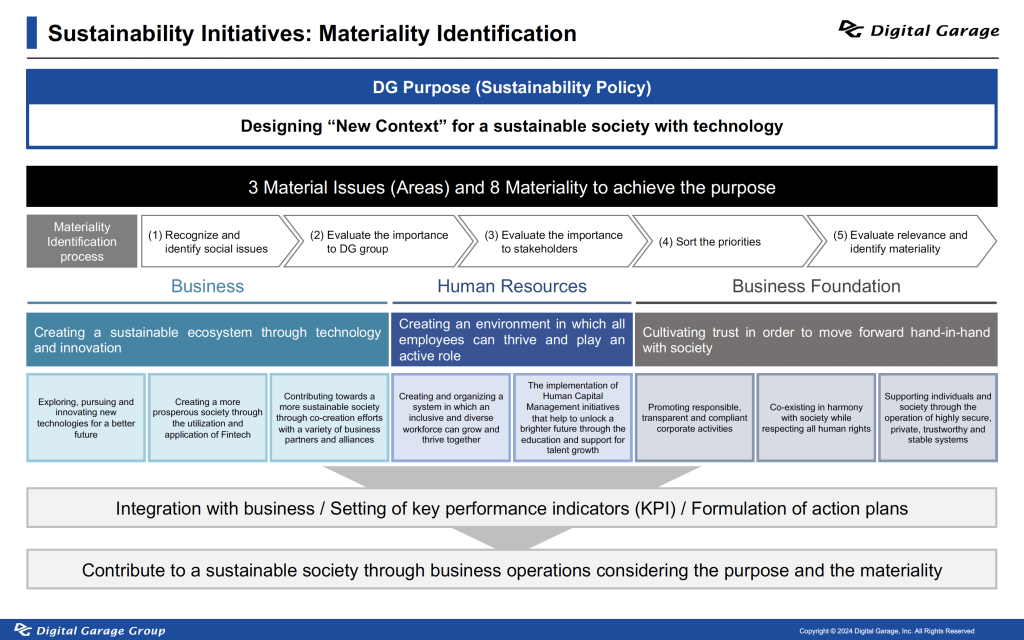

We have recently formulated “Materiality,” a set of priority issues that we must address to create a sustainable society and achieve sustainable growth for our company.

We have identified social issues by utilizing international standards such as the GRI Standards and other global frameworks. We interviewed all internal and external directors, shareholders, local governments, management, and young employees.

2 materialities were established in the area of human resources, 3 in the area of infrastructure, and 3 in the area of business like following.

Please refer to the slide of “Materiality,” including the area of human resources and infrastructure below.

Integrating the formulated materiality with the business and implementing the action plan will be more critical in the future. We will continue to promote sustainability management as it is crucial for our company’s growth, as it leads to business opportunities and risk reduction through business operations that respond to social issues and changes.

Finally, we are also working on Generative AI, which is attracting global attention as a new technology, mainly through our incubation center, “DG717,” in San Francisco.

GenLab, a STARTUP STUDIO based in DG717, launched in June 2023 and supports startups that create new value through Generative AI and peripheral technologies from various perspectives. It has held three “Generative AI Hackathons” to encourage the development of innovative software and services using Generative AI.

Also, this year, DG717 will host a global pitch featuring the latest technology and decarbonization startups worldwide. This will be archived and available for public viewing later. Working with entrepreneurs and engineers in Silicon Valley, DG aims to construct a community based on the global incubation stream it has built over the past 20 years. This community includes companies from Japan, the U.S. East Coast, Europe, and other regions.

Last year, we announced a new five-year Medium-term Plan, which is now in its second year. In order to optimize our business portfolio to achieve the plan, we have already begun a fundamental reform of the group structure, mainly in the PS segment, and in each of the other segments. By analyzing the evolution of rapidly changing technology, we intend to continuously implement the latest technology in society and build the next-generation global Internet ecosystem.

We will create an environment that enables our stakeholders to see the Fintech business’s growth and manage our resources more efficiently. We will drive our business forward by effectively utilizing our alliance with the Resona Group, with KDDI, a major telecom company with which we will begin an alliance this fiscal year, and with the Group’s own media group.

We look forward to your continued support and encouragement.