DG Mail

DG Mail is an online magazine that provides you with the latest news from the Digital Garage Group.

If you would like to subscribe to DG Mail, please fill out the form.

Designing

New Context

Designing

New Context

CEO Comment Vol. 83 “FYE March 2025 Financial Report Summary”

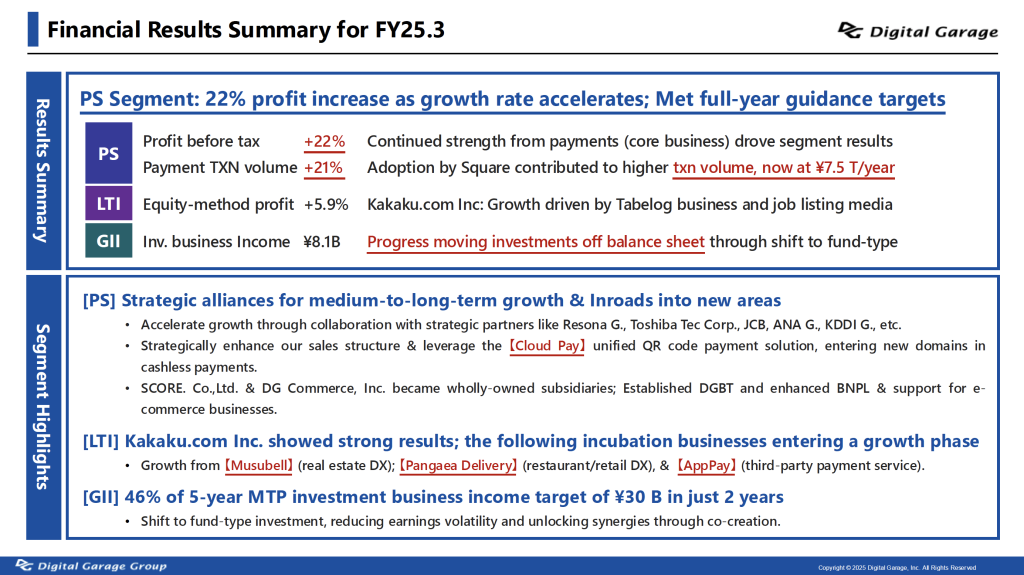

The PS (Platform Solution) segment outperformed market growth, achieving a 22% increase in profit. We expect to maintain this high growth rate in the current fiscal year. Although our investment business recorded a non-cash accounting loss in the second quarter, we have made significant progress in off-balancing, achieving 46% of our five-year target. Both Kakaku.com and the development of next-generation businesses are also progressing steadily.

With the approval of the Board of Directors today, we have announced FY25.3 financial results (IFRS).

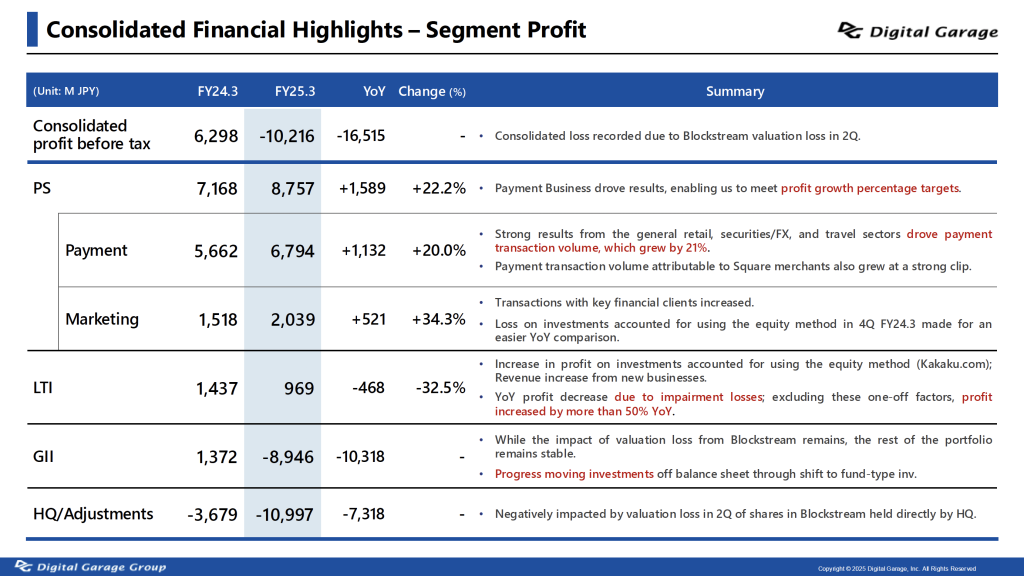

Consolidated operating results for the fiscal year ended March 31, 2025, show revenues of ¥38,306 million (up ¥453 million or +1.2% from the previous year) and loss before income taxes of ¥10,216 million (income of ¥6,298 million in the last year).

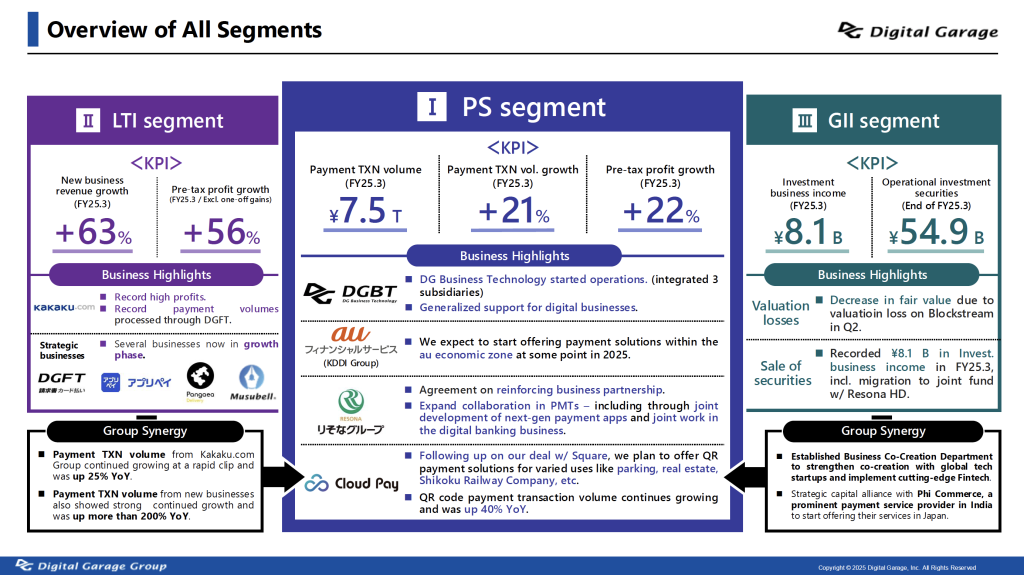

The PS segment, which is positioned as the Group’s core business platform, achieved strong growth, with pre-tax income up +22%, driven by the mainstay payment business. The segment continued to maintain high growth due to the contribution of strategic alliances in offline payments and the implementation of Cloud Pay, a QR code payment solution, on Square, one of the world’s largest payment platforms. Both offline and online transactions outpaced market growth, maintaining double-digit growth. Annual transaction volume increased by 21% to ¥7.5 trillion.

In the LTI (Long-term Incubation) segment, strong performance in Kakaku.com’s Tabelog restaurant review business and its job listing media business led to a 5.9% increase in equity-method profit. Additionally, payment transaction volume from Kakaku.com continued to grow steadily.

In the GII (Global Investment Incubation) segment, a loss on operational investment securities was recorded in the 2nd quarter as a non-cash accounting loss due to a significant decrease in the fair value of Blockstream. On the other hand, the transfer to a joint fund with Resona Group was completed, resulting in ¥8.1 billion in investment business income.

Below is a summary of financial results for the fiscal year ended March 31, 2025, and consolidated financial highlights segment income.

Additionally, the following are the main business highlights and segment summaries. Please take a look at this slide first.

In the PS Segment, we have reorganized the Group’s solution companies and conducted M&A to launch a new company, DG Business Technology, Inc. (DGBT), which is engaged in comprehensive digital business support optimized for the AI generation. We aim to maximize group synergies with DG Financial Technology, Inc. (DGFT), which provides payment solutions and plays a central role in the Group’s strategy.

We are expanding growth by promoting collaboration with strategic partners such as Resona Group, Toshiba Tec Corporation, JCB, ANA Group, and KDDI Group. We have agreed with Resona Group to reinforce our business alliance and aim to achieve a transaction volume of ¥1 trillion by strengthening our payment business and next-generation Fintech business. We will jointly promote “establishment of a joint venture to enter the BaaS/digital finance business” and “development of next-generation payment applications.”

We are also working with au Financial Service of the KDDI Group to provide payment services to the au economic zone by the end of 2025.

In addition to implementing the QR code payment solution “Cloud Pay” on Square, we are expanding our partnerships to parking lots, real estate, vending machines, railroad companies, and others, as well as to cashless areas where devices can be used without terminals.

First, please review the “Progress of the Medium-term Plan (FY3/2024-FY3/2028)” slide.

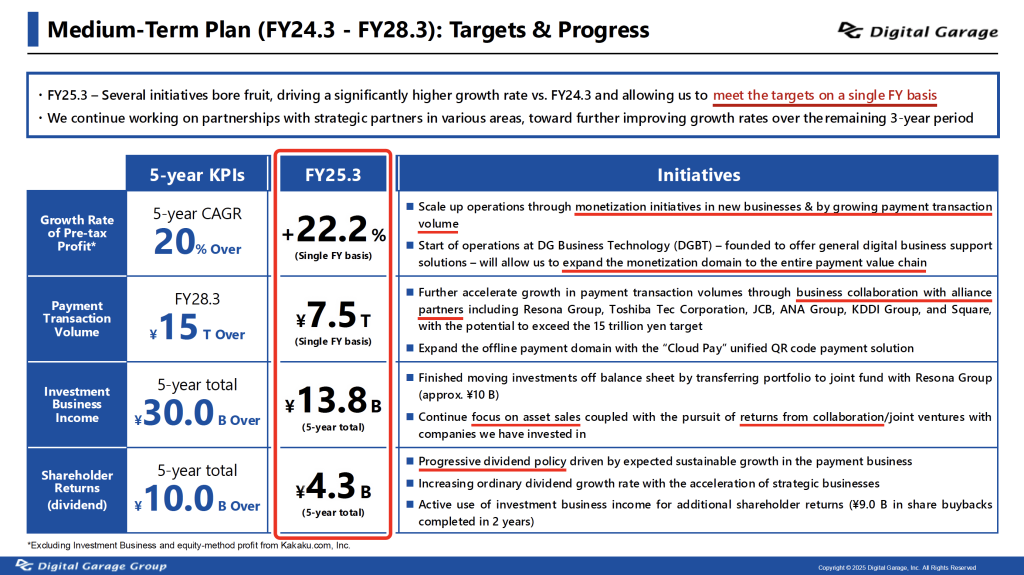

We have achieved our single-year targets for the 4 KPIs in our Medium-term Plan, which are “growth rate of pre-tax profit,” “payment transaction volume,” “investment business income,” and “shareholder returns (dividend).”

<Growth Rate of Pre-tax Profit>

To start, profit, excluding investment business and Kakaku.com’s equity in earnings, was 22.2%, compared to a 5-year CAGR of at least 20%, the target. We expect further growth in the current fiscal year, with the KDDI Group, the Resona Group, and other large projects, as well as QR code payments, for which we hold patents, showing high growth rates.

<Payment Transaction Volume>

Next, the payment transaction volume, an important KPI for the payment business, was ¥7.5 trillion, compared to the target of ¥15 trillion or more for the fiscal year ending March 31, 2028. Based on organic growth, we will add large-scale projects and launch the data intelligence business we have just announced to accelerate the 5-year payment transaction volume target.

<Investment Business Income>

The target for investment business income is a 5-year cumulative total of ¥30 billion or more. ¥5.6 billion in the first year of the Medium-term Plan (fiscal year ended March 2024) and ¥8.1 billion in the fiscal year ended March 2025, for a cumulative total of ¥13.8 billion (target achievement rate: 46%). We focus on risk minimization through diversified and strict management of the portfolio and business co-creation with Fintech businesses and AI startups.

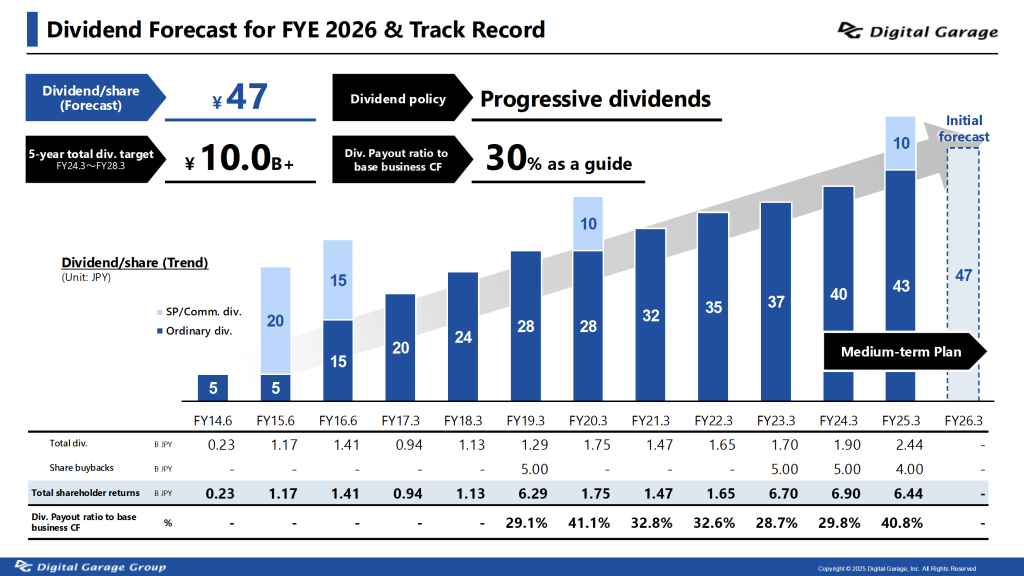

<Shareholder Returns (Dividend)>

Regarding dividends, the Company has set a 5-year total of ¥10 billion or more. For the fiscal year ended March 31, 2025, the Company has announced a policy of “progressive dividends” and will pay a commemorative dividend to celebrate the 30th anniversary of the Company’s establishment, bringing the cumulative total to ¥4.3 billion. Furthermore, in addition to returning profits to shareholders through dividends, we are flexibly returning additional profits to shareholders based on the progress of our business, and have already repurchased ¥9 billion of treasury stock during the period of this Medium-term Plan.

Note that the Company has been paying stable and increasing dividends for over 10 years and expects an ordinary dividend of ¥47 per share for the fiscal year ending March 31, 2026.

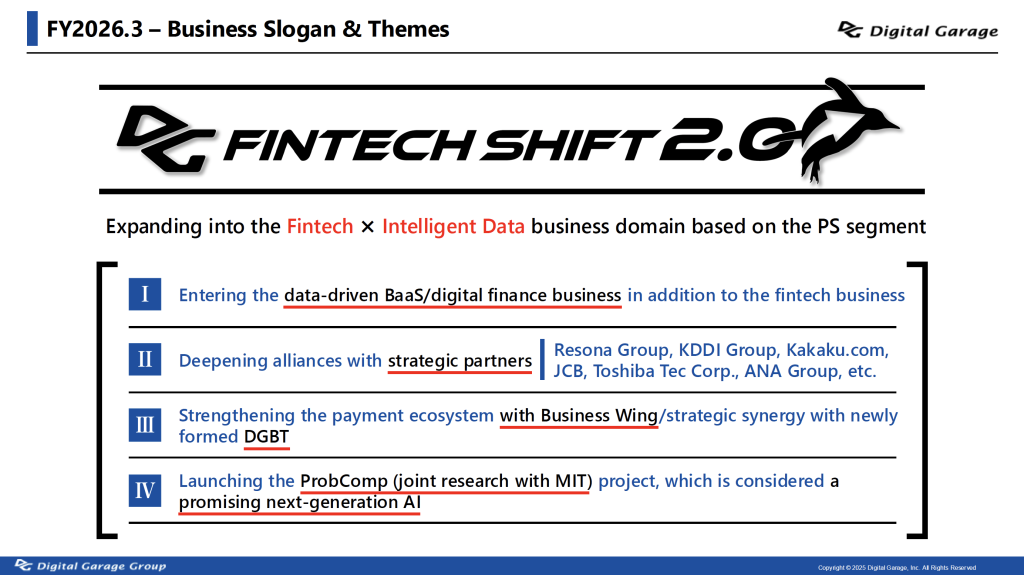

I would like to share the Digital Garage Group’s business strategy for the fiscal year ending March 2026.

Under the new slogan “Fintech Shift 2.0,” our strategic theme is to “Expanding into the Fintech × Intelligent Data business domain based on the PS segment.” Guided by this theme, we will advance the 4 key actions outlined in the following presentation slides.

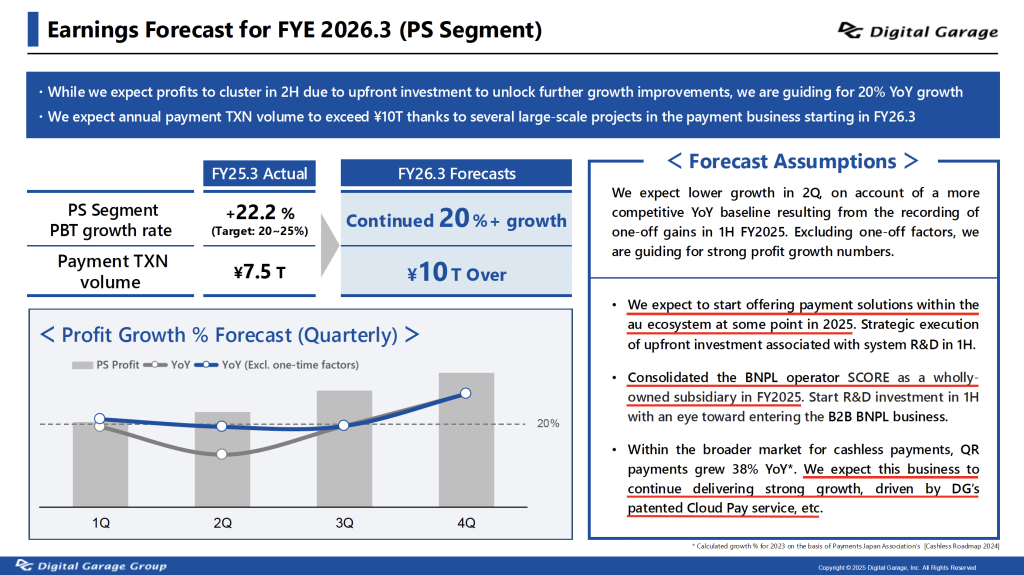

I would like to present our earnings forecast for the fiscal year ending March 2026, broken down by business segment.

To begin, we expect profits in the PS segment to cluster in 2H due to upfront investments aimed at enhancing long-term growth potential. For the full year, we are guiding for revenue growth of over 20% and annual payment transaction volume exceeding ¥10 trillion.

As shown in the slide below, the gray line in the bottom-left graph represents actual profit and loss. Growth is expected to slow in the second quarter and accelerate in the second half. This is primarily due to a recoil from one-off factors in the previous fiscal year, as well as the impact of planned development investments in Q2.

Several large-scale payment projects are expected to go live by the end of the year. These will help offset the upfront investments made in the first half and support our target of achieving over 20% annual growth.

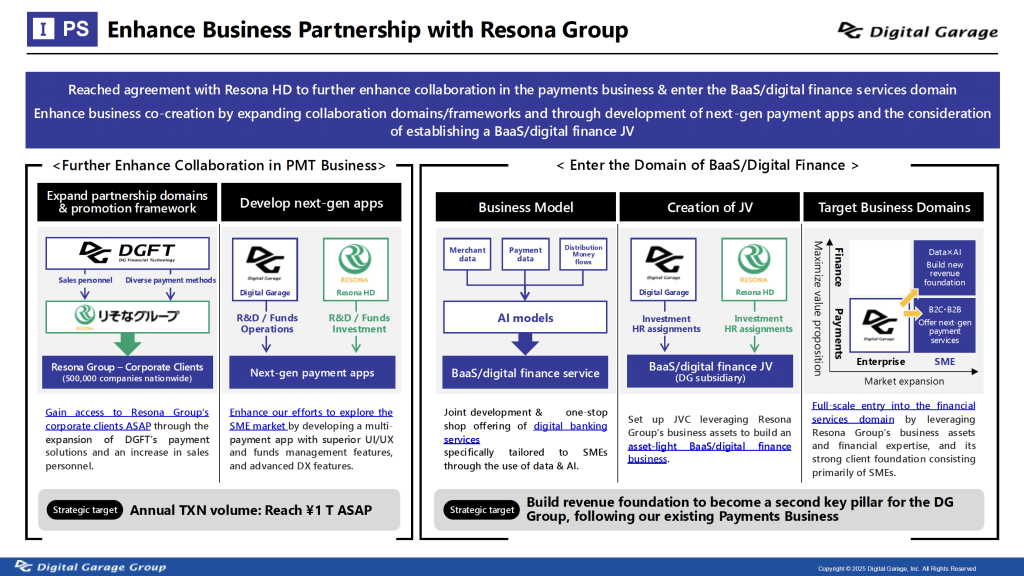

Our business alliance with the Resona Group is progressing steadily. We have recently reached a new agreement to further enhance collaboration in the payments business and to jointly expand into the BaaS (Banking as a Service) and digital financial services domain.

(For details, please refer to the May 13 press release: Digital Garage and Resona Group Agree on Partnership for Intelligent Data Business)

We are currently preparing 3 strategic initiatives in collaboration with the Resona Group.

The first focuses on further enhancing our partnership in the payments business. We are formulating bold initiatives from 2 complementary angles: enhancing client understanding and upgrading the sales capabilities of branch staff. As a first step, both companies will work together to deliver high-touch, value-added solutions to Resona Group’s network of 500,000 corporate clients.

The second initiative is the development of terminal-less payment and next-generation payment applications. Through this collaboration, we aim to create a service that combines outstanding UI/UX with advanced features such as fund management and DX tools. Our goal is to establish this offering as the de facto standard in Japan’s SME market.

The third initiative is our expansion into BaaS (Banking as a Service) and digital financial services. By leveraging merchant and payment data, as well as transaction and cash flow information, we will jointly develop AI-powered, SME-optimized services that provide end-to-end support. To enable the asset-light rollout of this business, we have begun discussions on establishing a joint venture that is planned to become a consolidated subsidiary of Digital Garage. This initiative marks a concrete step toward entering the financial services domain by combining Resona Group’s business assets and deep financial expertise with our technological capabilities. It also represents our commitment to building a new, revenue-generating business platform to complement our core payment segment.

Please see the following slides regarding the strengthened business alliance with the Resona Group.

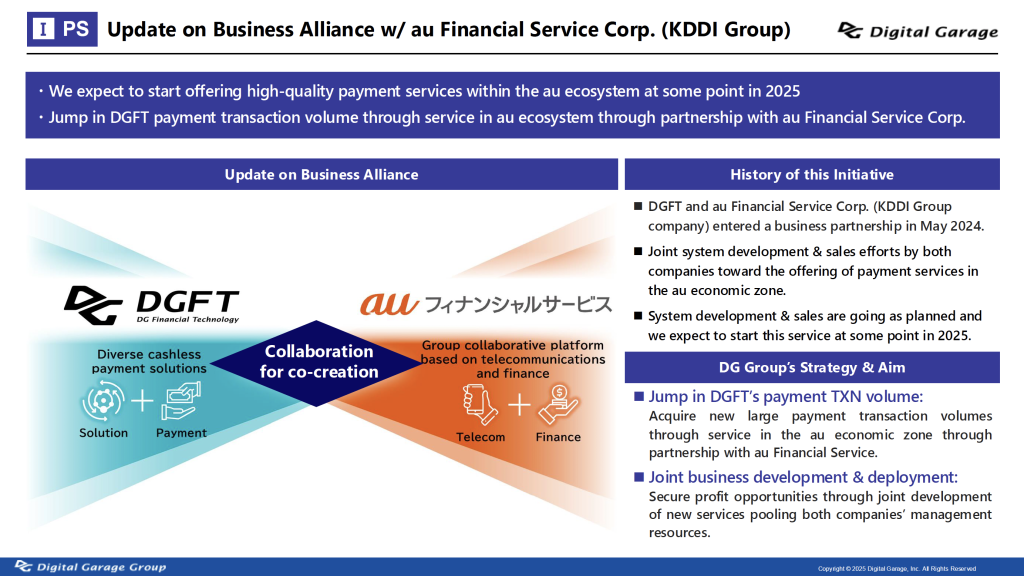

In May 2024, DGFT and au Financial Service entered into a business alliance agreement. Through this co-creation partnership, the two companies are steadily advancing system development and sales activities as planned, with the aim of launching payment services within the au economic zone by the end of the year.

By providing these services through this collaboration, DGFT and au Financial Service aim to secure substantial new transaction volume and generate revenue opportunities through the joint development of new services that leverage both parties’ management resources. This initiative is expected to significantly expand DGFT’s total payment transaction volume.

Further details of the project will be announced separately.

Please see the following slides for an update on the progress of our business alliance with au Financial Service.

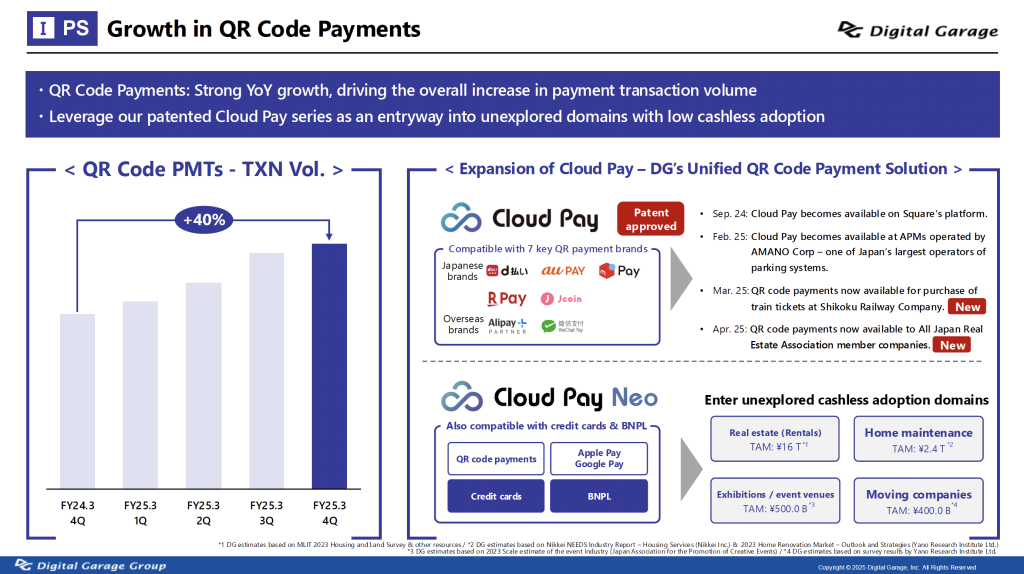

In the previous fiscal year, our unified QR code payment solution “Cloud Pay” was implemented into Square, one of the world’s largest payment platforms. As a result, approximately 200 million cumulative accounts across seven major QR code payment brands in Japan became compatible with our system. “Cloud Pay” is a patented solution that enables users to access multiple QR code payment services by simply scanning a single QR code with their smartphone. Our recently launched “Cloud Pay Neo” has also expanded compatibility to include credit card payments, which are the most widely used payment method. This eliminates the need for new hardware investment and provides a groundbreaking, next-generation strategic payment solution applicable to a wider range of retail scenarios.

Implementation is also being prepared in new sectors such as parking systems, regional real estate businesses, vending machines for beverages and games, and even JR Group facilities. In addition, expansion into previously untapped cashless markets is underway through terminal-less solutions that require no upfront investment.

We will continue to drive the expansion of next-generation QR code-based DX, which is experiencing rapid growth.

Please see the following slides for details on the growth of our QR code payment business.

We have prepared a video highlighting the latest developments in the “Cloud Pay” business. Please take a moment to watch it.

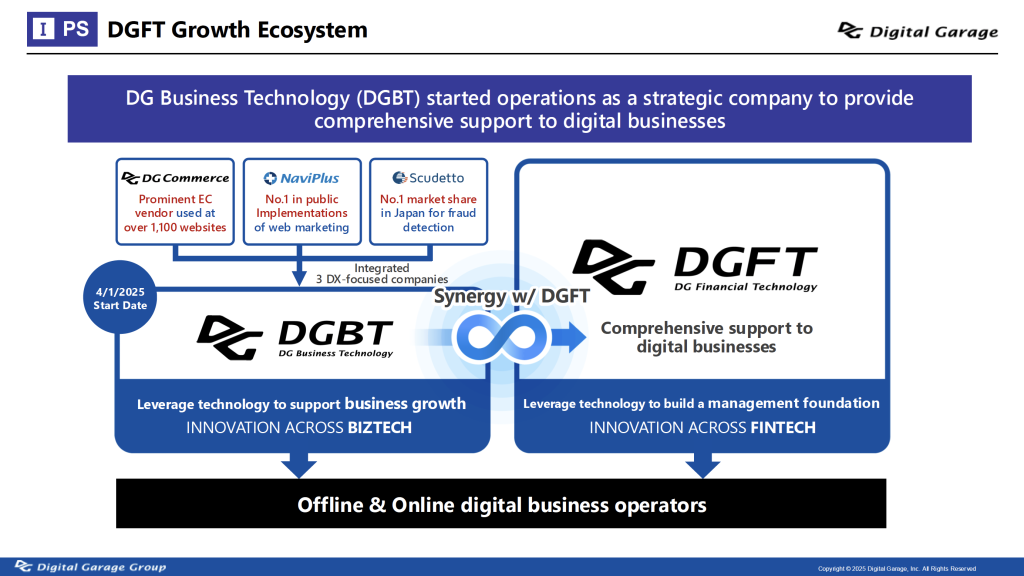

This spring, in April 2025, DG Business Technology (DGBT) started operations. DGBT is a strategic company formed through the integration of 3 of our group companies: NaviPlus, Japan’s No.1 in public Implementations of web marketing and a long-standing leader in supporting e-commerce businesses; DG Commerce, which became a wholly owned subsidiary after integrating the e-commerce division of a major system integrator with a proven track record of over 1,100 e-commerce site implementations; and Scudetto, the domestic market leader in comprehensive fraud detection solutions. By combining our group’s advanced technologies and marketing methodologies cultivated since our founding, DGBT aims to support the growth of digital business operators across both online and offline channels.

Together with DGFT, one of Japan’s leading payment providers, DGBT will serve as the other core pillar of our dual-platform structure. This structure enables us to provide end-to-end support for digital businesses—from strategy development to daily operations. We look forward to the continued evolution of this dual-engine system.

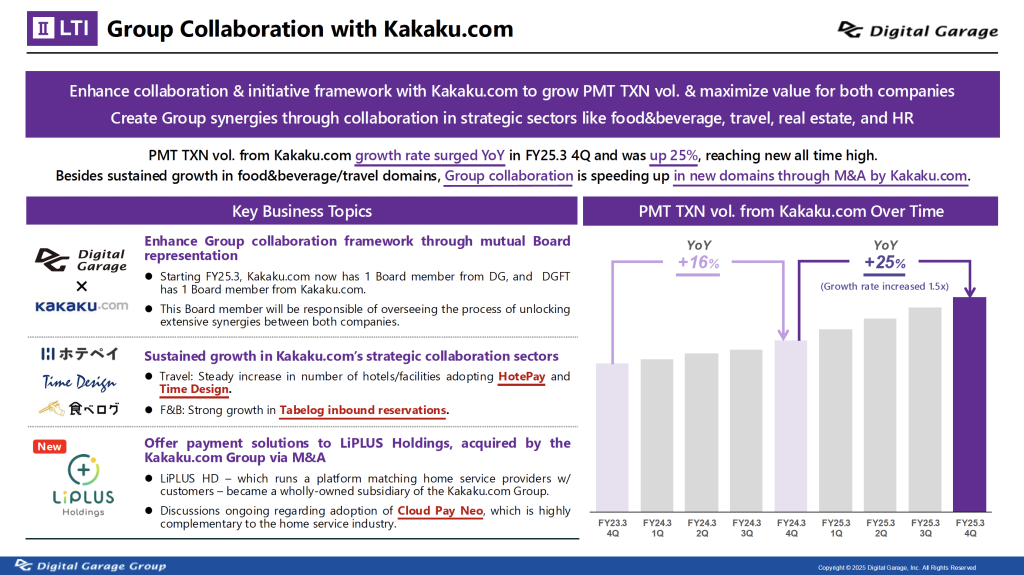

In the LTI segment, we are leveraging the strong traffic and customer base of the Kakaku.com Group to generate group-wide synergies by strategically focusing on sectors such as food&beverage, travel, real estate, and human resources.

In addition to the continued growth of initiatives such as “Hotepay” and “Time Design” in the hotel and travel domain, and “Tabelog Inbound reservations” in the food&beverage sector, we have also begun to formalize new initiatives in the real estate sector, centering on the steadily progressing “Musubell” project. Most recently, we have entered into discussions with LiPLUS Holdings, a provider of in-home service matching platforms recently acquired as a wholly owned subsidiary by Kakaku.com, regarding the implementation of “Cloud Pay Neo,” which offers strong compatibility with their business model. Preparations for integration are now underway.

Going forward, we will continue to deepen our multidimensional collaboration with the Kakaku.com Group, not only through payments but also by accelerating joint efforts in next-generation AI—such as the recently launched “ProbComp” project—and in the data intelligence business.

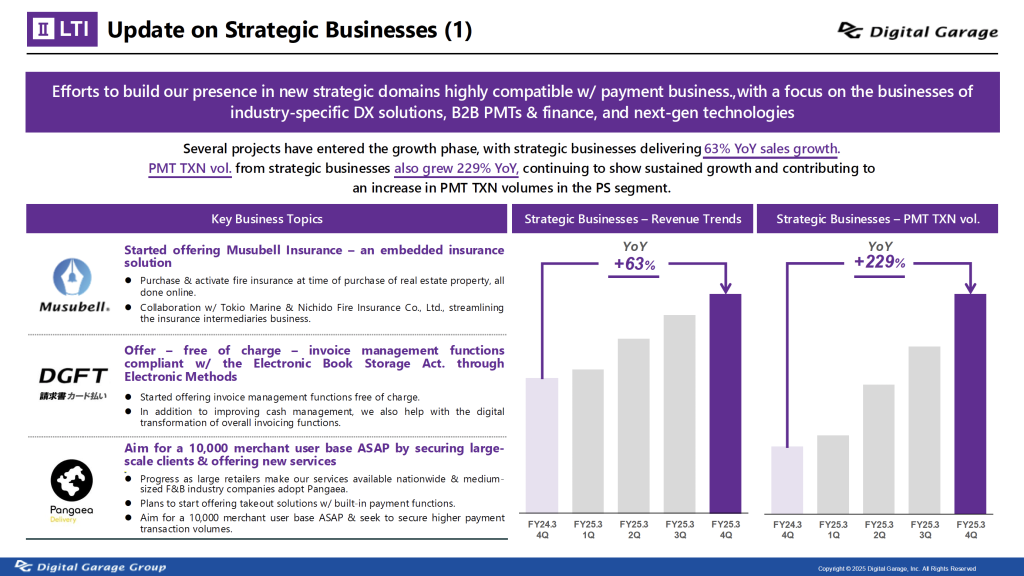

Among our various incubation-stage businesses, we are strategically advancing new business development in 3 key areas that have strong synergy with our payment business: industry-specific DX solutions, B2B payment and finance, and next-generation technologies. Revenue from this group of strategic businesses increased by 63%, while the payment transaction volume generated from these businesses surged by 203%, significantly contributing to the expansion of transaction volume in the PS segment.

In particular, “Musubell,” a DX service for the real estate domain, is emerging as a market leader and steadily expanding its share. Most recently, in collaboration with Tokio Marine & Nichido Fire Insurance Co., Ltd., Musubell launched a service to streamline operations for insurance agencies. We are promoting comprehensive digital transformation across a wide range of real estate use cases—including new developments, brokerage, homeowner associations, and property inspections—while steadily building partnerships with key players in each domain. In collaboration with a major credit card company, we have launched a new feature for our corporate payment service, “DGFT Invoice Card Payment,” that supports the management of received invoices in compliance with the revised Electronic Book Storage Act., which became fully mandatory in 2024. In addition, our retail tech service “Pangaea Delivery,” which provides centralized management and operations for online orders, is seeing expanded adoption—both through nationwide deployment by large retailers and increasing use among mid-sized restaurant chains and other food service businesses.

Please see the following slides for an update on the progress of our strategic businesses.

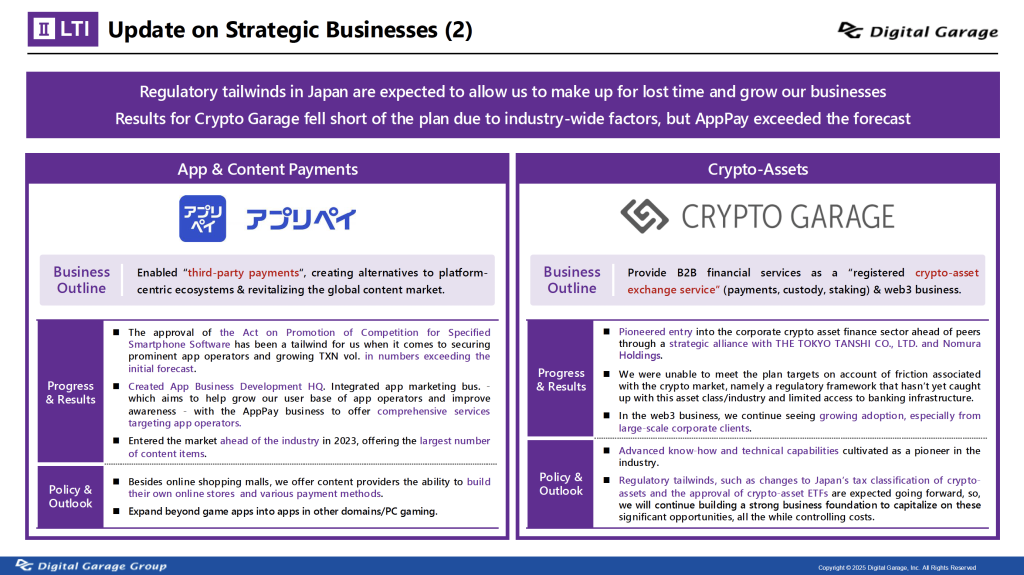

As part of our non-linear business initiatives aimed at implementing next-generation technologies in society, we are optimizing and expanding operations in cutting-edge domains, supported by favorable trends such as deregulation and new legal frameworks across respective industries.

●“AppPay” has made significant progress beyond initial expectations, spurred by the enactment of the Act on Promotion of Competition for Specified Smartphone Software. As a first mover in this field, the business is now expanding its reach beyond gaming into other content domains, and is exploring partnerships with overseas players offering similar services. Content providers have historically paid around 30% in transaction fees to major tech platforms. By optimizing these fees, AppPay enables providers to reinvest more into their content, thereby contributing to a healthier and more vibrant content ecosystem.

Looking ahead, we see strong potential for AppPay to facilitate the global distribution of Japan-originated content, as well as to support the delivery of high-quality overseas content to the Japanese market.

●Crypto Garage is a joint venture with THE TOKYO TANSHI and Nomura Holdings that operates a crypto asset financial services business for corporate clients. While progress has been delayed due to shifts in the financial regulatory environment, the web3 business continues to perform steadily, with revenue on the rise. As the first company to receive a crypto asset exchange service license for corporate clients from Japan’s Financial Services Agency, Crypto Garage possesses advanced expertise as a pioneer in the industry. The company is quietly working to strengthen its business foundation in anticipation of new growth opportunities arising from upcoming regulatory changes, such as Japan’s tax classification of crypto-assets and the approval of crypto-asset ETFs.

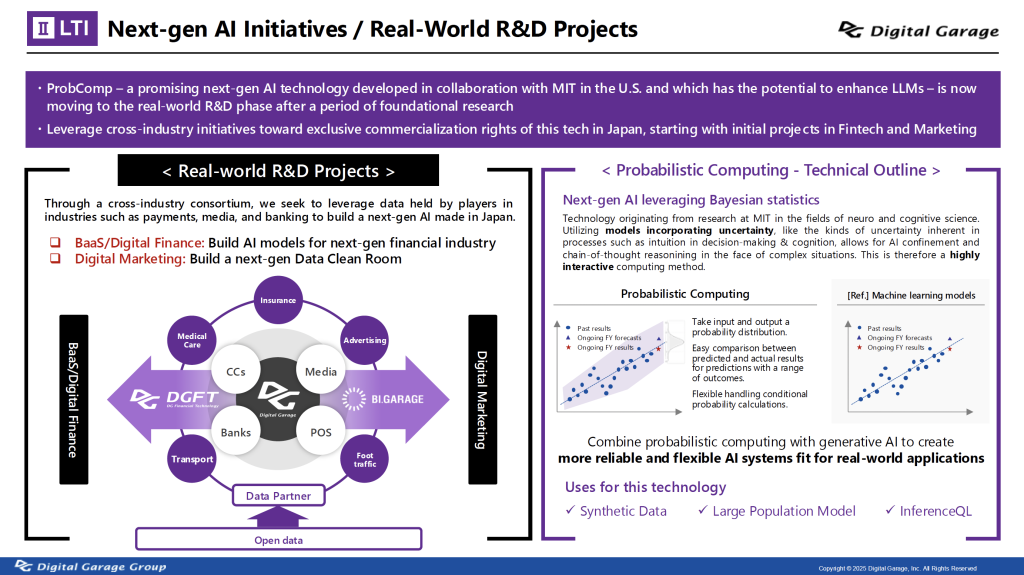

Next, we would like to introduce “Probabilistic Computing (ProbComp)” as part of our “Next-Generation AI Initiatives / Real-World R&D Projects.”

Generative AI, such as ChatGPT, has significantly transformed both business and everyday life. At the same time, it has also revealed challenges—including hallucinations, where AI generates incorrect or misleading information, and the massive power consumption required to build and run large language models (LLMs).

To address these issues, we have been conducting joint research since 2021 with the Computer Science and Artificial Intelligence Laboratory at the Massachusetts Institute of Technology (MIT), through Digital Architecture Lab (DALab), led by our co-founder Joi Ito. Our focus has been on “ProbComp,” a next-generation AI technology that has the potential to complement and integrate with Generative AI by combining reliability and flexibility.

By supplementing the weaknesses of Generative AI and integrating it with ProbComp, we aim to implement more trustworthy and versatile AI systems in society.

Following foundational research, we are now advancing practical R&D projects, in which we will initially focus on 2 key domains in Japan as the exclusive partner for ProbComp.

The first domain is Fintech and the BaaS/digital financial business, built on our core business and DGFT platform.

The second domain is Marketing and digital marketing based on the Quality Media Consortium, jointly operated by BI.Garage and consists of over 30 participating media companies.

In both of these strategic areas, we are initiating practical projects aimed at building next-generation businesses through the application of probabilistic computing. In parallel, basic research activities under the General Incorporated Association ProbComp are also beginning in collaboration with U.S. institutions, with Chiba Institute of Technology serving as the central hub in Japan.

Through collaborations with DGFT’s partner ecosystem, which spans banks, credit card companies, media outlets, POS systems, and QR code providers, as well as with leading companies across industries such as insurance, transportation, healthcare, advertising, government, and mobility analytics, we are launching data collaboration initiatives. By also engaging with data partners working with open data and open-source consortia, we will drive the real-world implementation of next-generation AI in the Fintech × Intelligent Data domain.

Please see the following slides.

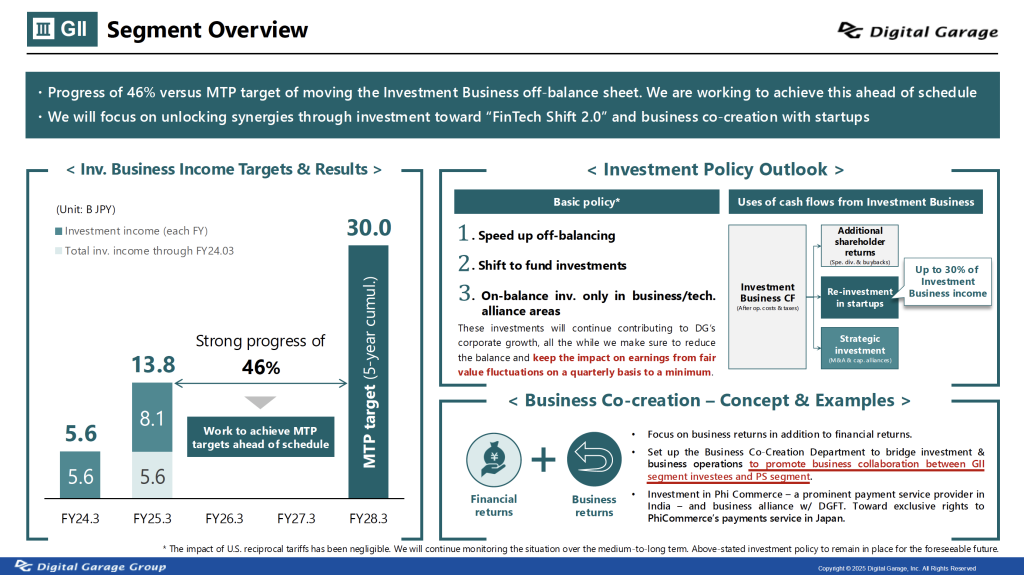

Moving on, I would like to give you an overview of the GII segment.

Given the impact of the fair value assessment of our investees on our business performance and the reduction of volatility, we are promoting the off-balancing of our investment business as outlined in our 5-year Medium-term Plan.

Against the Medium-term Plan’s target of ¥30.0 billion in investment business income by the fiscal year ending March 31, 2028, the company earned ¥5.6 billion in the fiscal year ended March 31, 2024 and ¥8.1 billion in the fiscal year ended March 31, 2025, for a cumulative total of ¥13.8 billion. We are making good progress, achieving 46% of our 2-year target. Specific studies are underway to achieve the goal ahead of schedule.

The top 5 large-scale companies, which account for 43% of the portfolio, continue to be monitored as a priority. For the rest of the portfolio, we recognize that diversification is in effect regarding value and geography, and that the revenue impact from individual issues is limited to the extent possible.

In addition to “accelerating off-balance financing” and “shifting to fund investments,” the current basic investment policy is to “carefully select on-balance financing investments with a view to business and technology partnerships.” With a particular focus on “business co-creation,” we have established a “Business Co-Creation Department” to promote collaboration with the startups of our investee companies and the businesses of our PS segment. We will focus not only on financial returns but also on generating business returns. We have recently invested in Phi Commerce, a leading Indian payment processor, and will start its expansion in Japan through collaboration with DGFT. We will continue working as a GII segment to achieve stronger cooperation from a strategic and global perspective to achieve further growth in the PS segment.

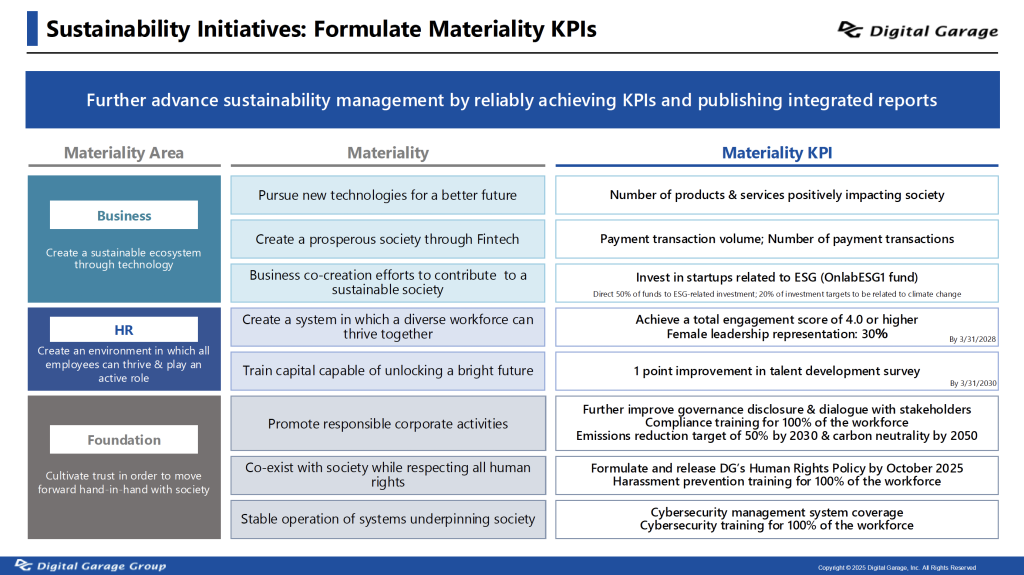

In December 2024, we published our first integrated report, “DG Integrated Report 2024,” which systematically summarizes financial and non-financial information on the Group’s mid- to long-term value creation efforts. Since our foundation, we have continued to implement cutting-edge technology in society in response to the needs of the changing times, and we explain our value creation process, management foundation, and future growth strategy. The report includes messages from each director, examples of specific businesses, services, and systems, trilogies by outside directors, and financial data. Starting with the business area, we have identified 3 materialities, 2 in the human resources area, and 3 in the infrastructure area, and have set KPIs for each of these materialities. Our efforts will continue to include non-financial information in addition to traditional financial information, and we will actively work to provide highly transparent information in an easy-to-understand manner.

As technology evolves and global conditions become increasingly uncertain, various social issues are emerging, and efforts to enhance sustainability are becoming more critical. By achieving KPIs in our business areas, we aim to create an impact in solving social issues. Moreover, by promoting efforts to achieve KPIs in human resources, governance, security, and other fundamental areas that drive our business, we aim to enhance our corporate value and contribute to building a more sustainable society.

By continuously pursuing these KPIs, we will improve the effectiveness of our sustainability management.

Please review the following slides on our sustainability efforts.

Last but not least, amidst rapidly changing technology and business environment, we will maintain and continue the profit growth of more than 20% in our core businesses through strategic and organic alignment of the DG Group’s 3 segments. From this fiscal year, we will start building the next-generation business revenue base in the Intelligent Data business to achieve further growth.

We look forward to your continued support and encouragement.